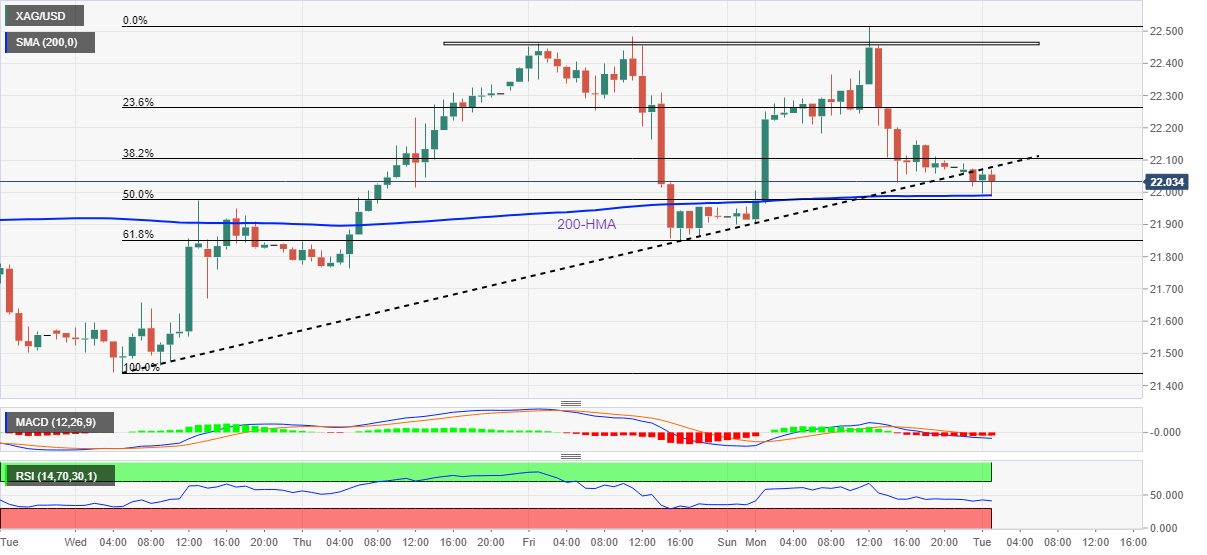

Silver Price Analysis: 200-HMA probes weekly support break as XAG/USD sellers attack $22.00

- Silver remains pressured between previous support and 200-HMA.

- Bearish MACD signals, RSI (14) keep sellers hopeful to approach $21.00.

- 61.8% Fibonacci retracement acts as an extra filter to the south.

Silver (XAG/USD) takes offers to renew intraday low around $22.00 during Tuesday’s Asian session. In doing so, the bright metal justifies the latest downside break of a one-week-old ascending trend line as bears attack the 200-HMA support.

Given the bearish MACD signals and descending RSI (14), not oversold, XAG/USD prices are likely to decline further.

However, a clear downside break of the 200-HMA level near $22.00, as well as the 61.8% Fibonacci retracement level of June 01-06 upside, near $21.85, becomes necessary for witnessing a heavy fall. The reason could be linked to the double top formation of around $22.50.

During the quote’s weakness past $21.85, the theoretical target of $21.00 lures the bears but the recent swing low near $21.45 may offer an intermediate halt during the declines.

Meanwhile, recovery moves need to jump back beyond the previous support line, around $22.10 by the press time.

Following that, silver buyers may again aim for the double tops surrounding $22.50, a break of which could propel prices towards May’s peak near $28.30.

Silver: Hourly chart

Trend: Further weakness expected