Back

14 Apr 2022

Crude Oil Futures: Upside appears limited

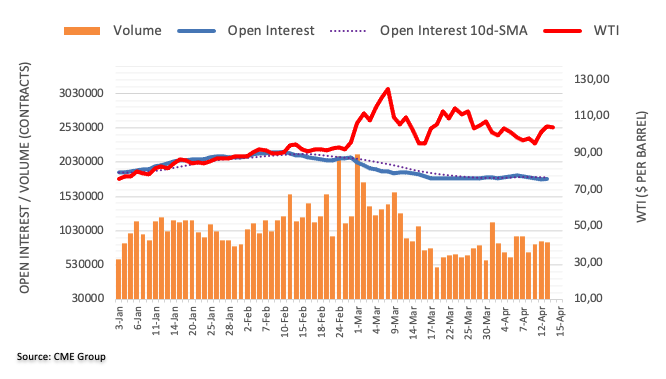

CME Group’s flash data for crude oil futures markets noted investors trimmed their open interest positions by nearly 6K contracts on Wednesday, extending the downtrend for the fifth session in a row. In the same line, volume reversed two consecutive daily builds and dropped by around 15.5K contracts.

WTI: Another drop to $95.00 is not ruled out

Wednesday’s gains in prices of the WTI were in tandem with shrinking open interest and volume, showing the presence of short covering behind the daily uptick. That said, further upside is not favoured in the very near term, opening the door to a corrective downside to, initially, the $95.00 region.