Back

10 Mar 2022

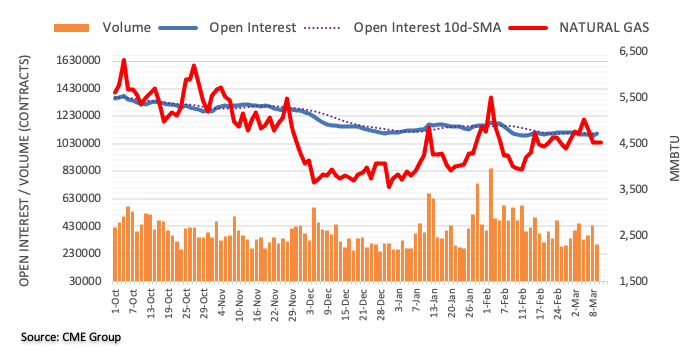

Natural Gas Futures: Further decline in the pipeline

Considering advanced prints from CME Group for natural gas futures markets, traders added around 16.3K contracts to their open interest positions following two daily drops in a row on Wednesday. On the other hand, volume dropped by around 143.5K contracts after two straight daily builds.

Natural Gas remains supported by the 200-day SMA

Wednesday’s leg lower in prices of natural gas was accompanied by increasing open interest, which favours the continuation of this trend at least in the very near term. In the meantime, the 200-day SMA at $4.36 per MMBtu is expected to hold the downside for the time being.