Back

31 Jan 2022

Crude Oil Futures: Further rangebound seems favoured

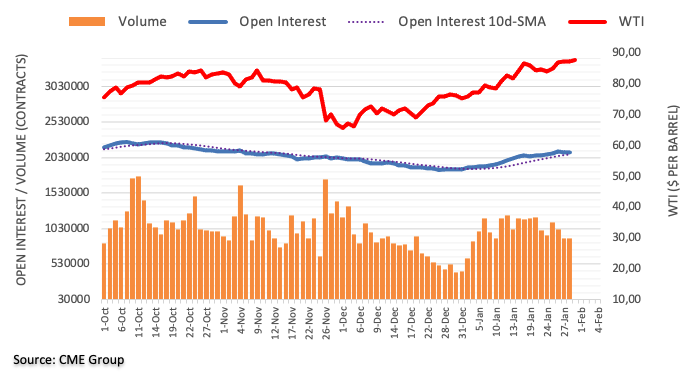

CME Group flash data for crude oil futures markets noted traders trimmed their open interest positions for the second straight session on Friday, this time by around 11.4K contracts. Volume, instead, reversed two daily drops in a row and went up by more than 7K contracts.

WTI still targets the $90.00 mark near term

Prices of the WTI charted another inconclusive session at the end of the week amidst diminishing open interest and volume, which could leave the current consolidative stance somewhat unchanged at least in the very near term. In case crude oil resumes the upside, the next target of note remains at the $90.00 mark per barrel.