EUR/USD awaits crunch-time ECB interest rate (taper) decision

- The ECB is the main event for today's finical markets.

- EUR/USD is consolidated at the 61.8% golden ratio and awaits the outcome.

- Investors are nervous that the global economy is slowing yet inflation is near a decade high.

The European Central Bank's Governing Council is the showdown for markets on Thursday as investors and forex traders brace for impact while the hawks circle over Frankfurt.

Numerous ECB members have publicly called for a reduction in the pace of bond purchases, to at least return to the early 2021 pace.

Therefore, there are prospects of a de-facto taper to the long end of the central bank's asset-buying programme.

As Bundesbank President Jens Weidmann said last week,

“the first P in PEPP stands for pandemic, not permanent, and for a good reason.”

The meeting will be followed by President Lagarde’s press conference which will be a potentially volatile event.

''Communication risks are high, and Lagarde will want to avoid sounding overly hawkish, instead emphasising "persistence",'' analysts at TD Securities explained.

''QE was accelerated in March, to about EUR85bn per month, to deal with widening yield spreads within the Eurozone,'' analysts at Westpac explained.

''But no decision is expected on the EUR1.85 trillion pandemic emergency purchase program (PEPP), which is on track to be exhausted in March 2022. New quarterly forecasts on growth and inflation should be little changed or perhaps slightly higher.''

In preparation for the meeting, investors cashed in and moved to the sidelines, as evident in the European stock declined.

Stocks skidded to their lowest in nearly three weeks and were down 1%.

Eurozone inflation is at its highest levels in nearly a decade which makes for a tricky ground for investors to tread.

Fears that central banks might start to taper their asset purchases seems to have knocked away a little confidence,'' Deutsche Bank analysts said in a note.

Meanwhile, the US dollar has picked up an ongoing risk-off bid which has teleported the DXT index to fresh recovery highs in 50% mean reversion of the prior daily bearish impulse.

Hawkish commentary from Federal Reserve members as well as stronger US yields this week has further buoyed the mighty greenback.

For instance, St. Louis Fed president James Bullard recently told the Financial Times that the central bank should go forward with a plan to start trimming stimulus this year despite the data.

Also speaking n Wednesday were New York Federal Reserve President John Williams and Dallas Fed President Robert Kaplan, both advocating for tapering:

Fed's Williams: Appropriate to start reducing pace of asset purchases this year

Fed's Williams: Asset valuations are very high

Fed Kaplan: He will revise down 3Q GDP because of covid

This leaves the US dollar in good stead leading into the ECB which remains the wild card for markets at the end of this week.

However, as analysts at TDS argued, ''the price action feels a bit random, lacking any real motivation and drivers.''

''FX will likely tune in to the broader risk sentiment and global growth outlook, where a firmer USD has dovetailed with negative global data surprises.''

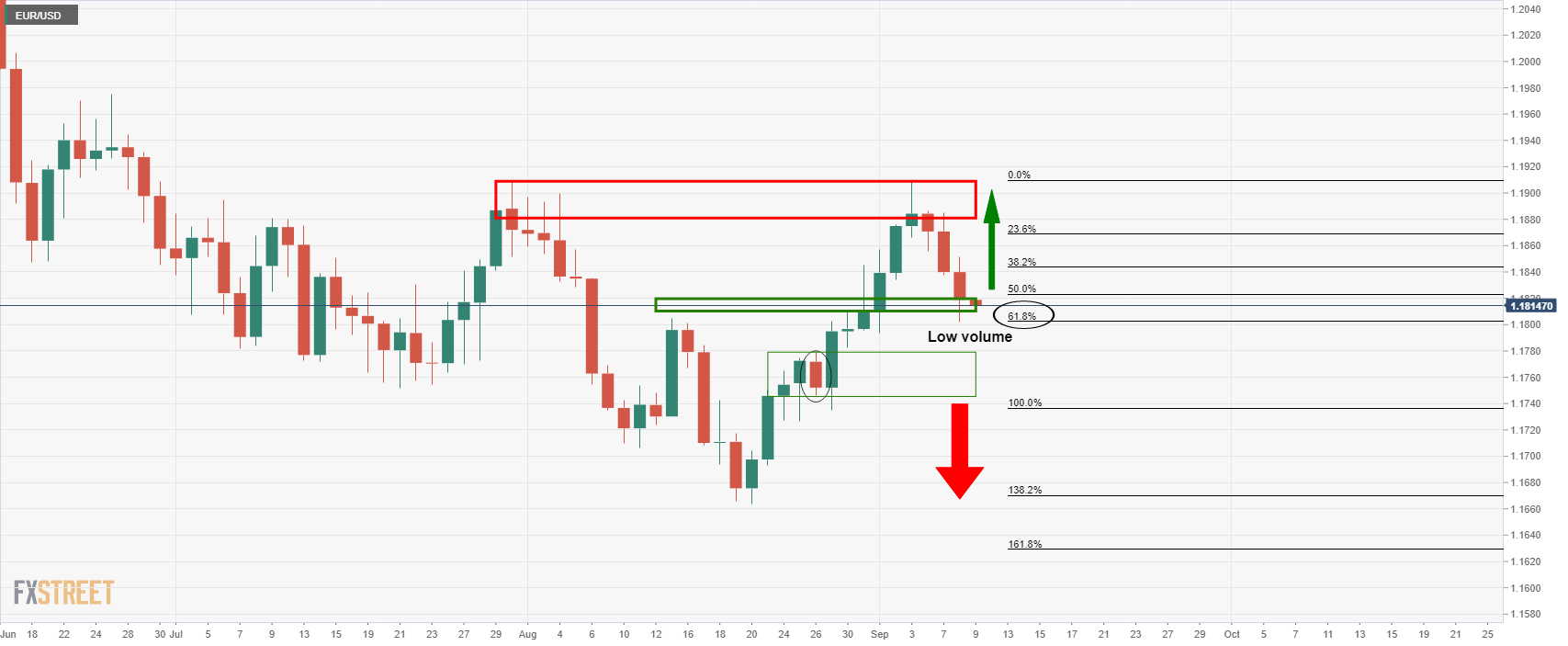

EUR/USD technical analysis

The low volume area is a target for the market to capitalise on should the ECB outcome be less hawkish than priced for.

A break of 1.18 the figure opens risk to 1.1750 26 Aug business.

On the other hand, given the price has already met the 61.8% ratio.

Bulls could surge from here to restest the territories towards the 1.19 figure in the coming sessions on a hawkish outcome with some dry powder in the flanks around the meeting today.