S&P 500 Index opens lower as financial stocks slide on Fed's SLR announcement

- Wall Street's main indexes trade in the negative territory.

- Financial stocks suffer heavy losses after Fed declines to extend SLR rule.

- S&P 500 Communication Services Index is posting small gains.

Major equity indexes started the last day of the week deep in the red after the US Federal Reserve announced that it will not extend the big bank leverage rule and will let it expire by the end of March as scheduled.

During the coronavirus crisis, the Fed relaxed the supplementary leverage ratio (SLR) to allow banks to exclude Treasurys and deposits from their reserve requirements.

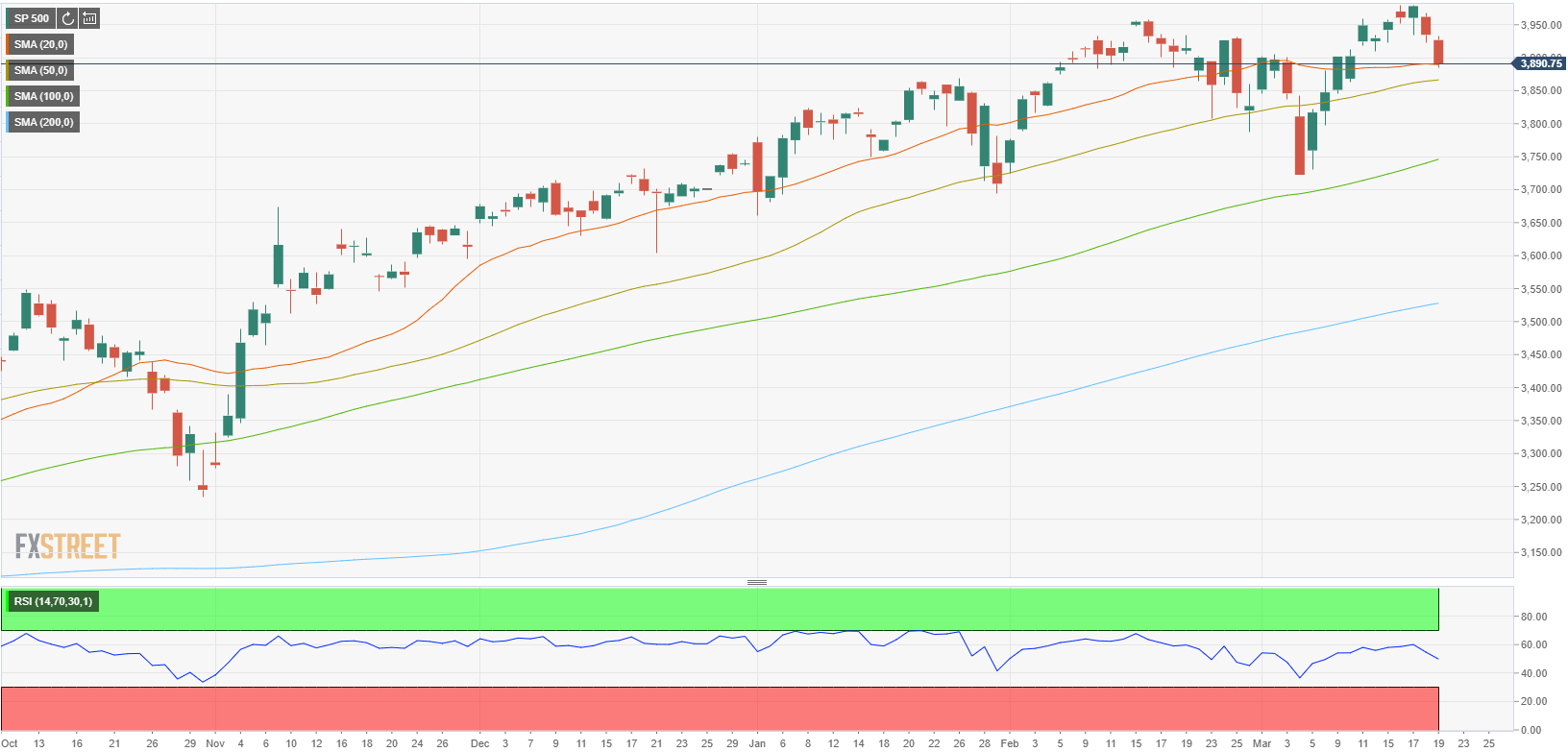

As of writing, the Dow Jones Industrial Average was down 0.9% on the day at 32.568, the S&P 500 was losing 0.62% at 3,890 and the Nasdaq Composite was falling 0.45% at 12,735.

Among the 11 major S&P 500 sectors, the Financials Index is down 1.75% on the day as the worst performer after the opening bell. On the other hand, the Communication Services Index is posting small daily gains.

S&P 500 chart (daily)