Back

11 Jan 2021

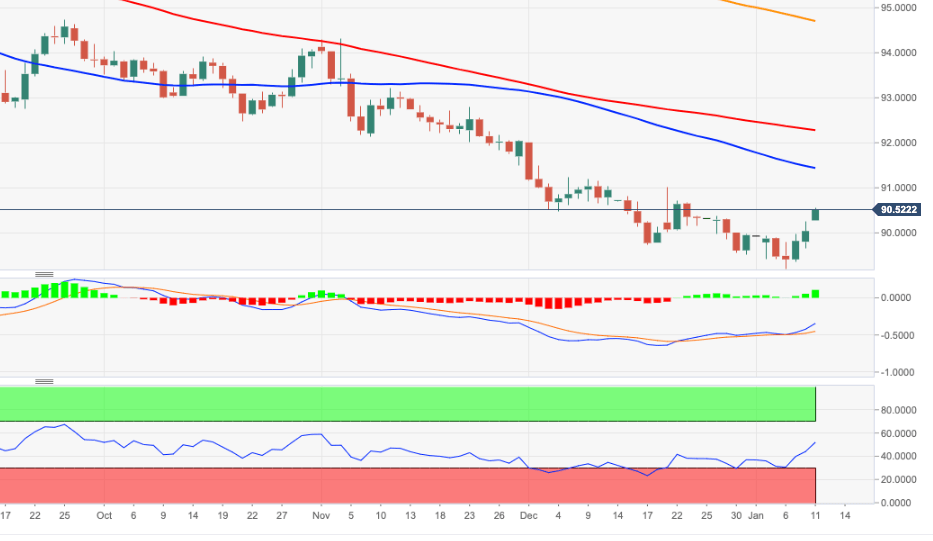

US Dollar Index Price Analysis: Next on the upside emerges 91.00

- DXY consolidates the breakout of the 90.00 mark.

- A serious move above 90.00 could reach the 91.00 yardstick.

After bottoming out in fresh lows around 89.20 last Wednesday, the dollar managed to regain (now) important buying attention and extends the move past the 90.00 level o Monday.

If the bullish attempt becomes more sustainable, then there is the chance of a move to the weekly high in the 91.00 region (December 21). Above this level, the prevailing downside pressure is expected to mitigate somewhat.

In the longer run, as long as DXY trades below the 200-day SMA, today at 94.69, the negative view is forecast to prevail.

DXY daily chart