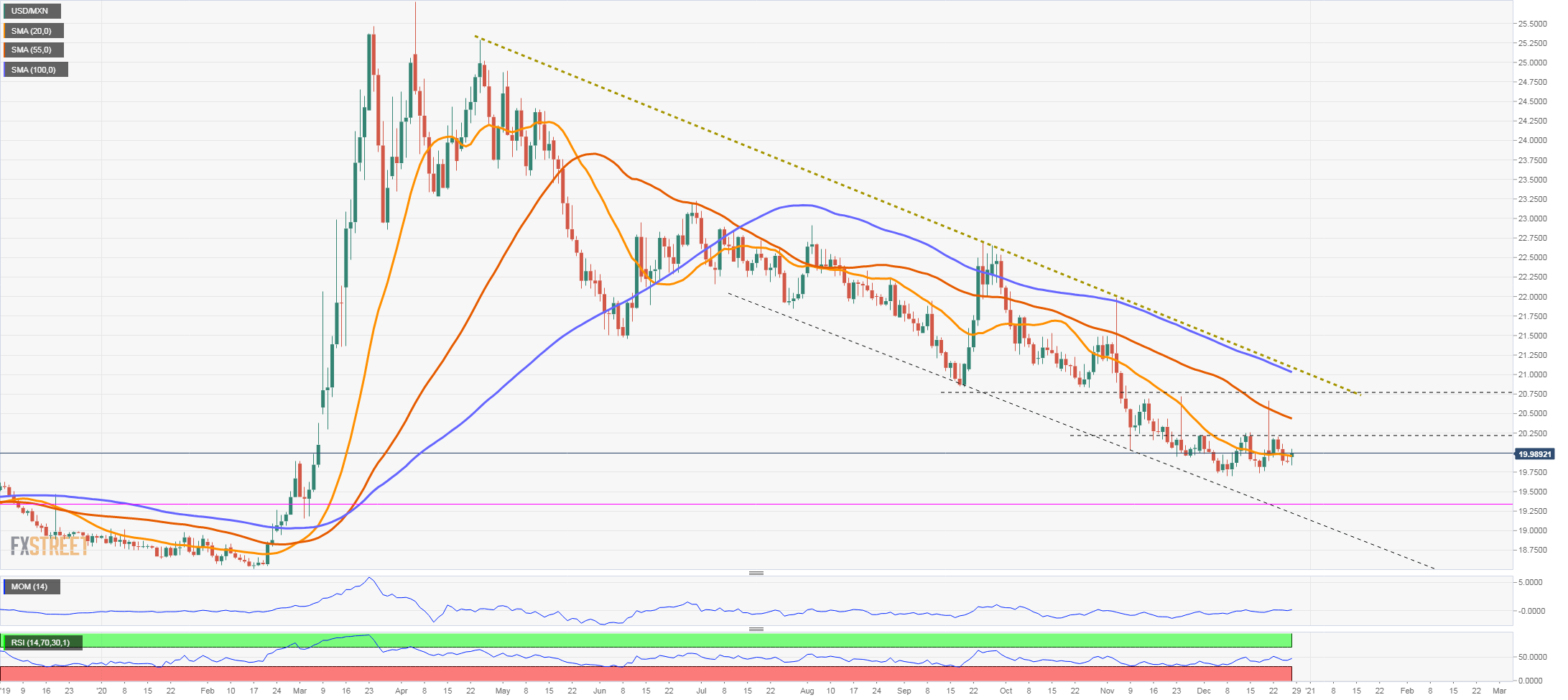

USD/MXN Technical Analysis: Mexican peso outlook remains bullish, trapped around 20.00

- Mexican peso moves sideways versus the US dollar in the short-term.

- The downside is limited by 19.70, while the key resistance stands at 21.10.

The USD/MXN is trading on a consolidation range, hovering around 20.00. It remains in a descendant channel with a bearish bias on a wider perspective. The rebounds of the US dollar have been unsustainable above 20.25, while on the flip side, the Mexican peso was not strong enough to break 19.70.

A daily close above 20.25 would suggest more strength for the dollar. A critical resistance is seen at the 20.75 area, and then comes the key 21.10 zone that contains an eight-month downtrend line, and the 100-day moving average. A break higher would change the bias to neutral/bullish.

A consolidation below 19.70 would open the doors to more losses, with a target at 19.45/50 that should limit the decline, at least momentarily. Below the next support could be seen at 19.20, the lower limit of the descendant channel.

USD/MXN daily high