Back

29 Sep 2020

Crude Oil Futures: Rebound could extend further

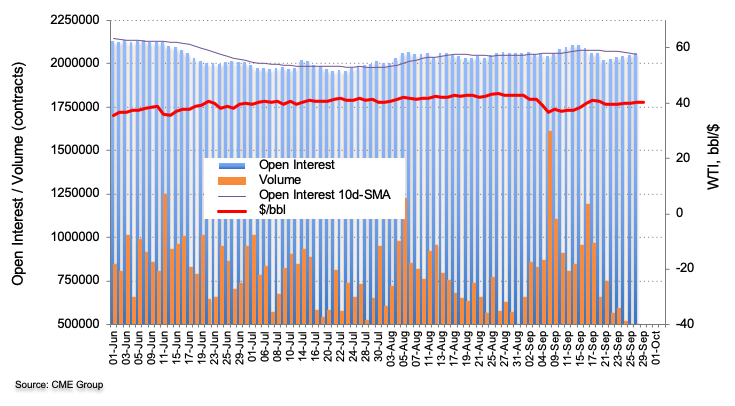

CME Group’s advanced readings noted traders added around 7.1K contracts to their open interest positions in crude oil futures markets on Monday, clinching the fifth consecutive build. Volume, instead, shrunk for the third session in a row, this time by around 79.5K contracts.

WTI still looks to $41.50

Crude oil prices started the week on a positive footing and looks to consolidate business above the key $40.00 mark per barrel. Monday’s optimistic session was in tandem with rising open interest, opening the door to the continuation of the move up in WTI with initial target at recent peaks near $41.50 (September 18).