Gold Price Analysis: $1,775 probes XAU/USD bulls amid overbought RSI conditions

- Gold prices refresh the highest levels since October 2012.

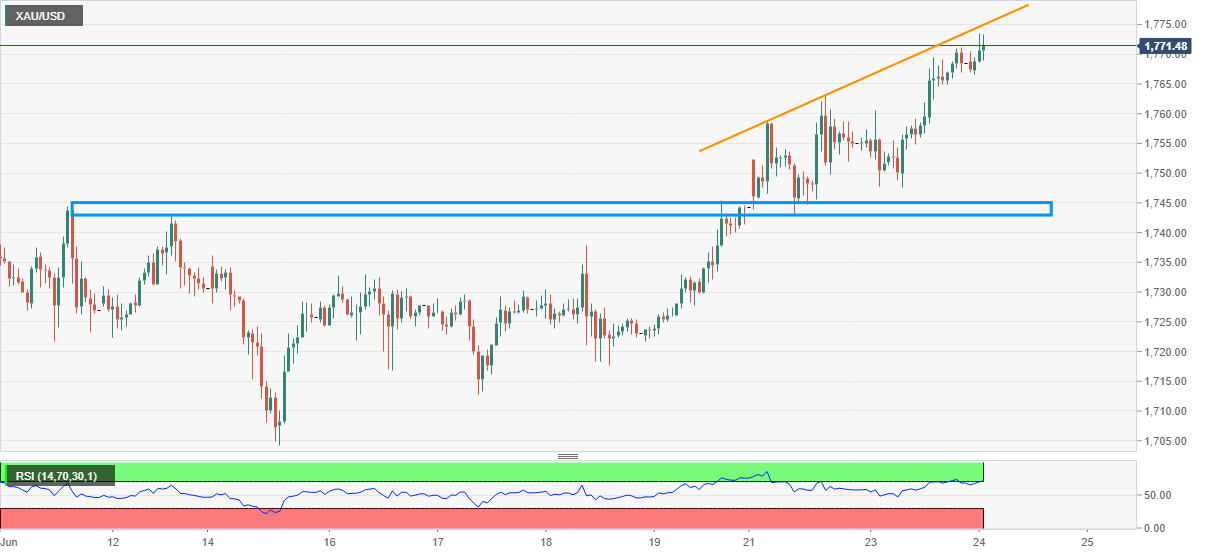

- An ascending trend line connecting highs from Monday offers immediate resistance.

- A two-week-old horizontal support area gains the sellers attention during the pullback.

- Overbought RSI, nearness to short-term key resistance line signals pullback.

Gold prices take the bids near $1,773, up 0.24% on a day, during the early Wednesday’s trading. In doing so, the yellow metal refreshes the highest point since October 2012 with an intraday peak of 1,773.54. Though, a weekly resistance line is likely an immediate problem for the bulls amid overbought RSI conditions.

As a result, the sellers remain hopeful unless the bullion breaks above $1,775. However, they will refrain from fresh entries before the quote slips below Monday’s high of $1,758.74.

During the precious metal’s fall below Monday’s peak, a short-term horizontal area around $1,745/43 will be the key as it holds the gate for further weakness towards $1,730 and $1,700 supports.

On the upside, the safe-haven’s rise past-$1,775 will push it towards the year 2012 top near $1,795. Additionally, $1,800 round-figures and November 2011 high close to $1,803 are some extra challenges that the bulls will have to clean afterward.

Gold hourly chart

Trend: Pullback expected