Back

18 May 2020

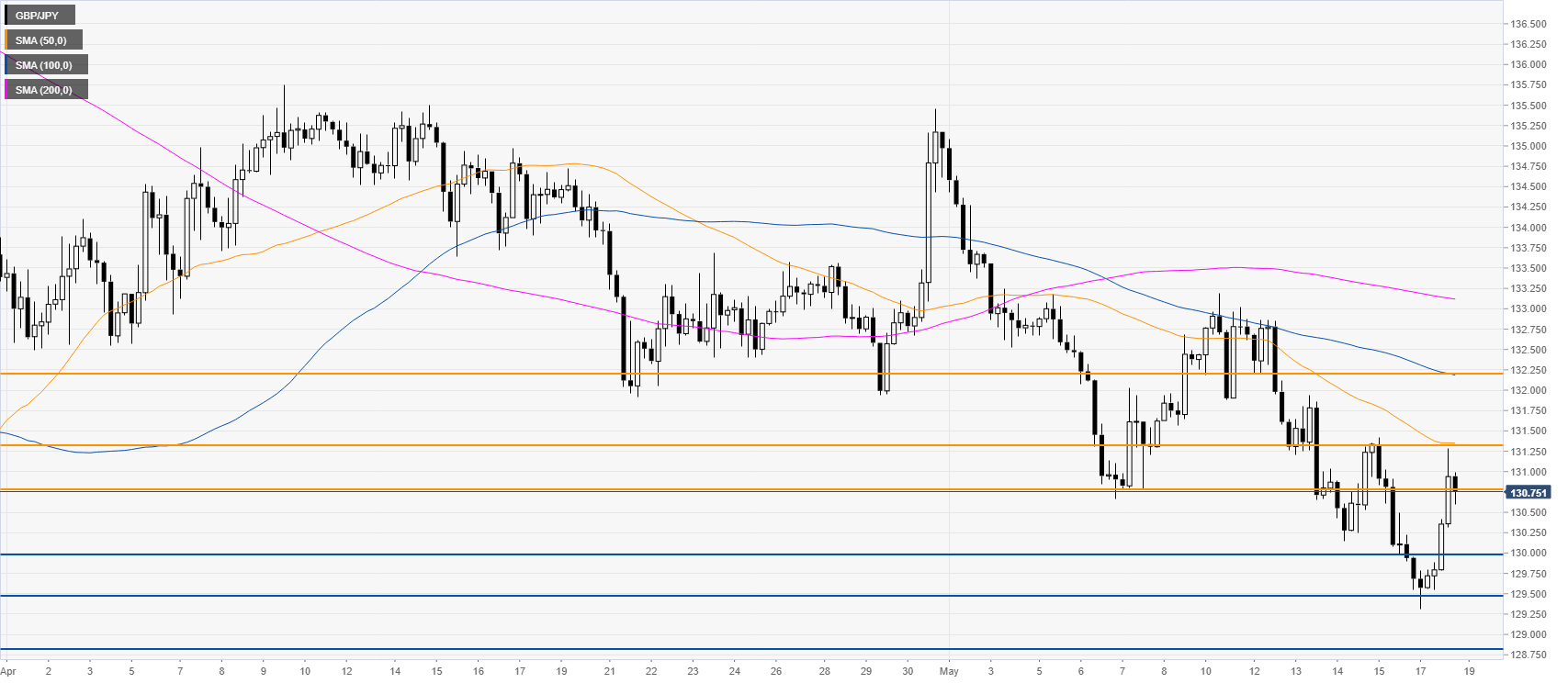

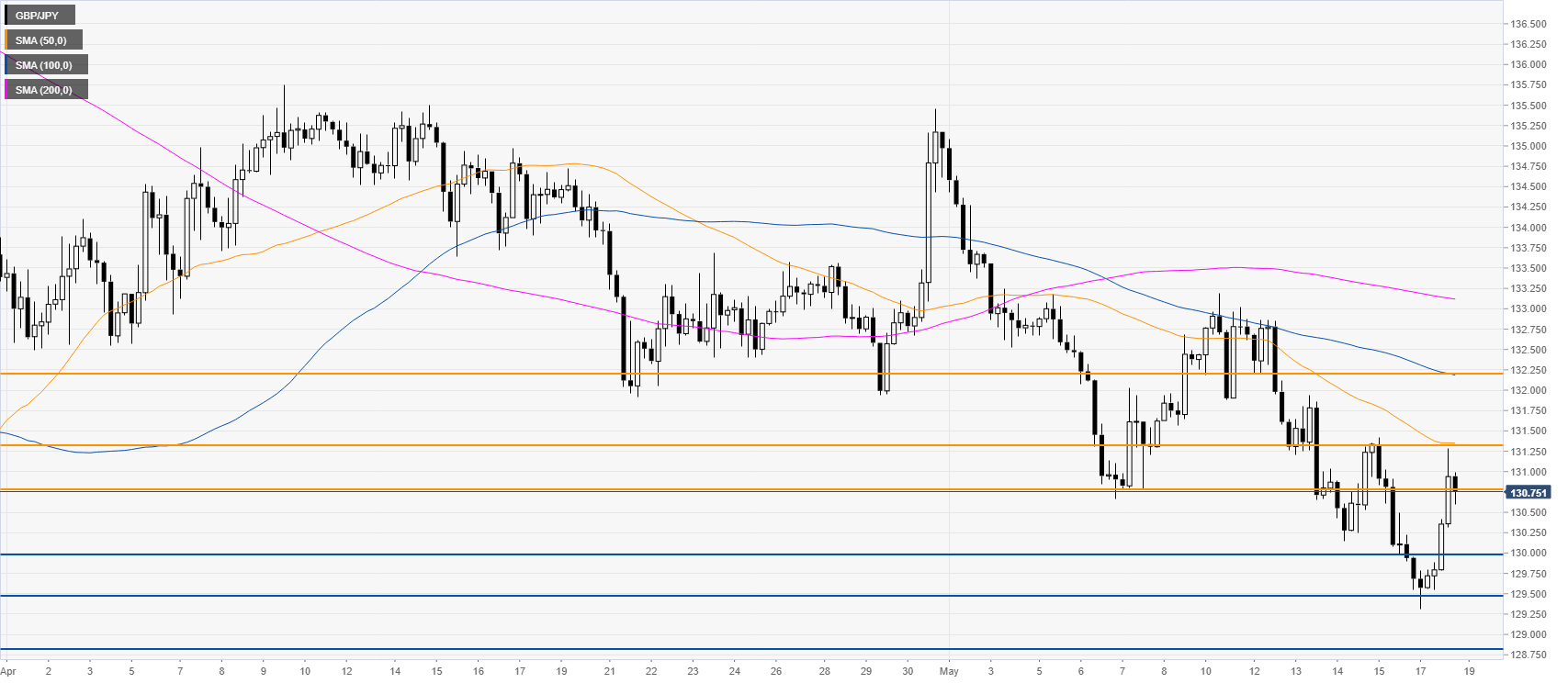

GBP/JPY Price Analysis: Pound pops and falters near 131.00 figure, bearish

- GBP/JPY starts the week with a modest pop to the 131.00 figure.

- The level to beat for sellers is the 130.00 figure.

GBP/JPY four-hour chart

GBP/JPY is trading below its main SMA on the four-hour chart while making lower lows and lower highs, suggesting negative momentum as the currency cross is trading off 6-week lows. Sellers remain in full control and further price declines are to be expected with the spot likely targetting 130.00, 129.45 and 128.81 price levels to the downside. On the flip side, the recent pop found strong resistance near the 130.80 level. Further up lie the 131.46 and 132.29 levels.

Resistance: 130.80, 131.46, 132.29

Support: 130.00, 129.45, 128.81

Additional key levels