Back

26 Mar 2020

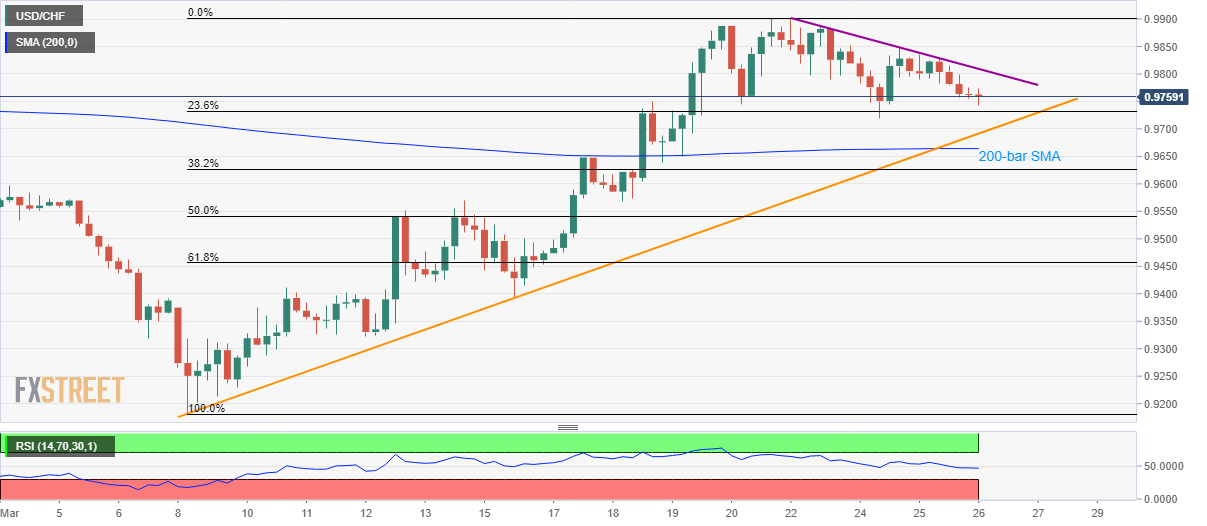

USD/CHF Price Analysis: Pullback from 0.9900 eyes monthly support trendline

- USD/CHF remains on the back foot.

- The weekly resistance line guards the immediate upside.

- 200-bar SMA question sellers below the short-term support line.

While extending its pullback moves from 0.9900, triggered during the early-week, USD/CHF drop to 0.9755, down 0.15%, amid the Asian session on Thursday.

The pair currently drops towards the monthly support line, at 0.9690, a break of which could again shift the market’s focus on a 200-bar SMA level of 0.9660.

If bears fail to respect the key SMA, 50% Fibonacci retracement level of the monthly run-up, at 0.9540, will be the key to watch.

On the contrary, the pair’s break above the weekly resistance line of 0.9810 could trigger fresh recovery moves that target 0.9900.

Also, the pair’s sustained rise past-0.9900 could challenge November 2019 high around 1.0025.

USD/CHF four-hour chart

Trend: Pullback expected