Back

25 Mar 2020

EUR/USD Price Analysis: Euro consolidates selloff, battles with 1.0800 figure

- EUR/USD is consolidating below the 1.0850/80 resistance zone.

- The level to beat for bears is the 1.0780 support for a test of the 2020 lows.

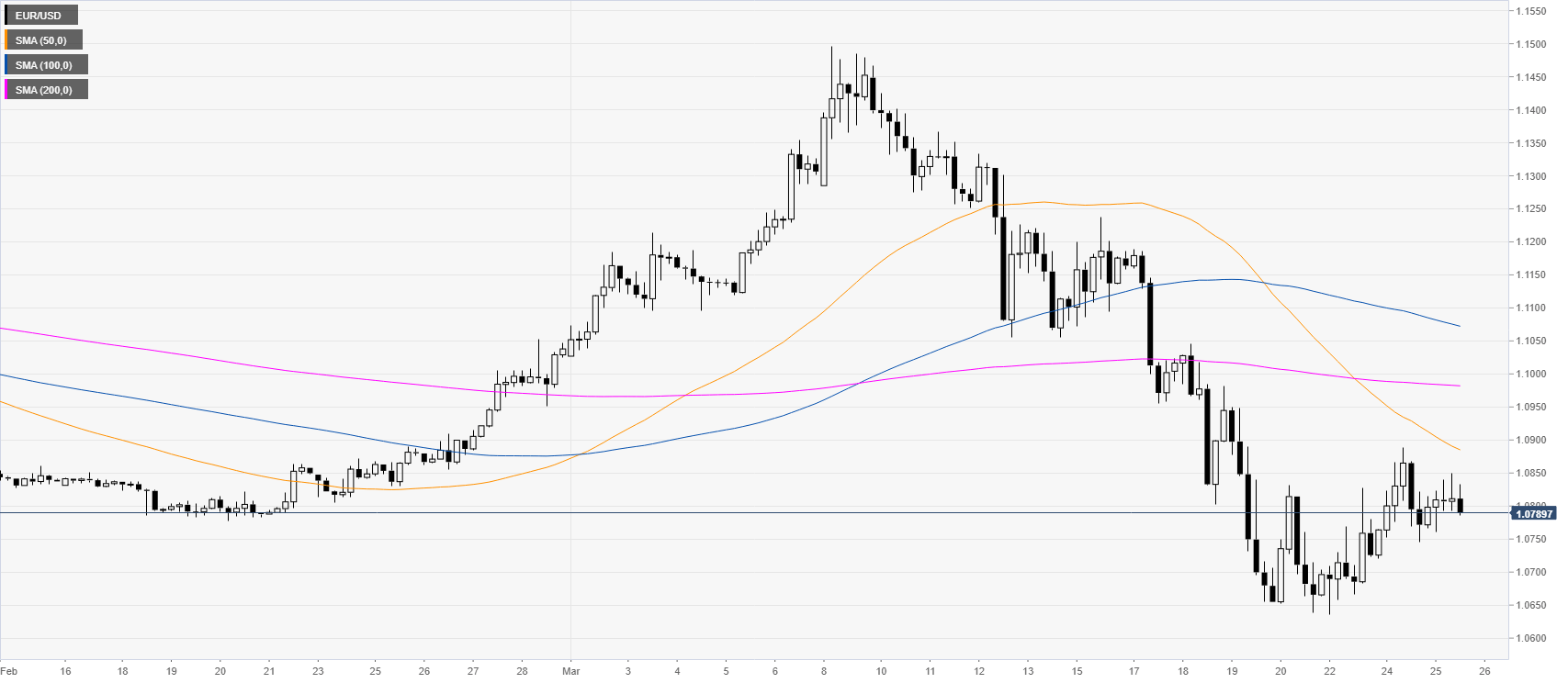

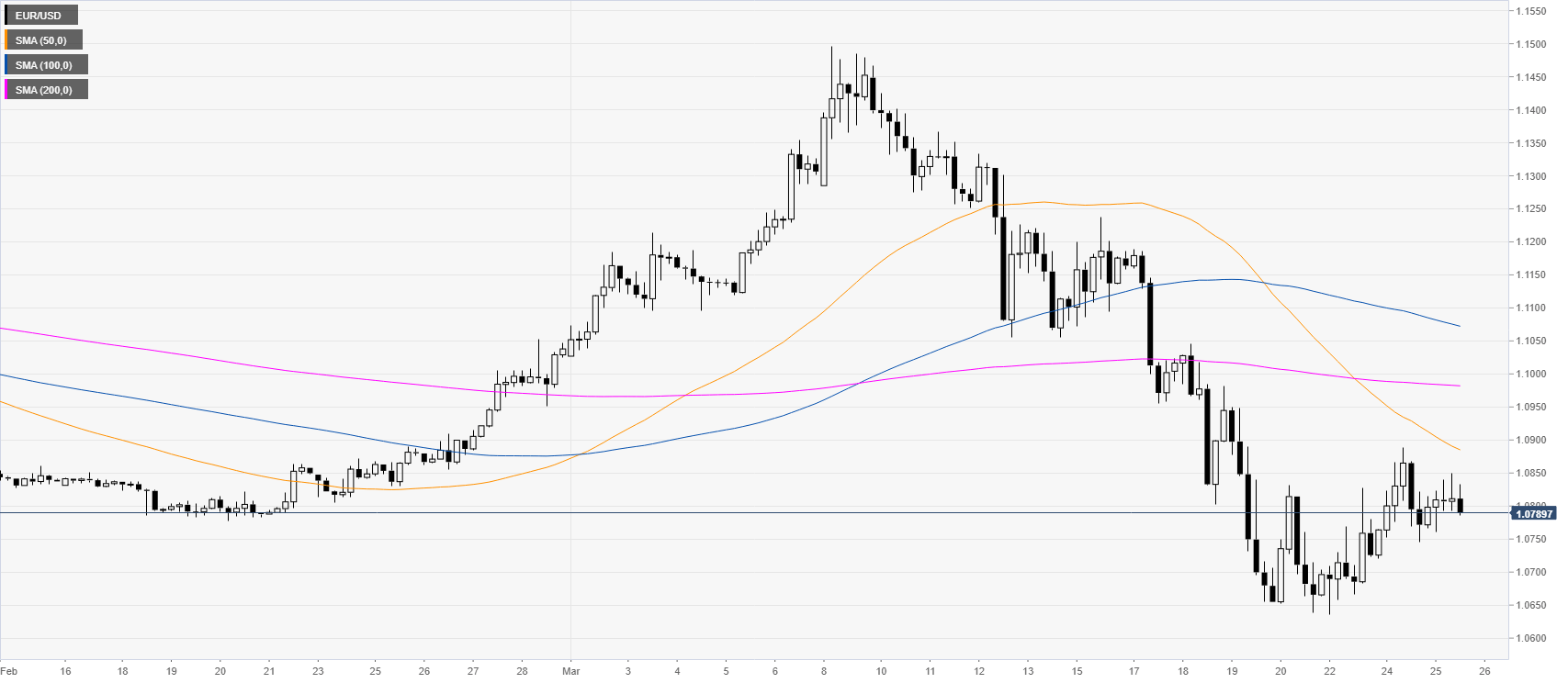

EUR/USD daily chart

After a steep selloff in early March, EUR/USD is consolidating near 37-month lows as the Fed announced, this Monday, its largest stimulus package ever. The Quantitative Easing (QE) can be basically limitless. “The Federal Reserve will continue to purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions,” the Fed stated.

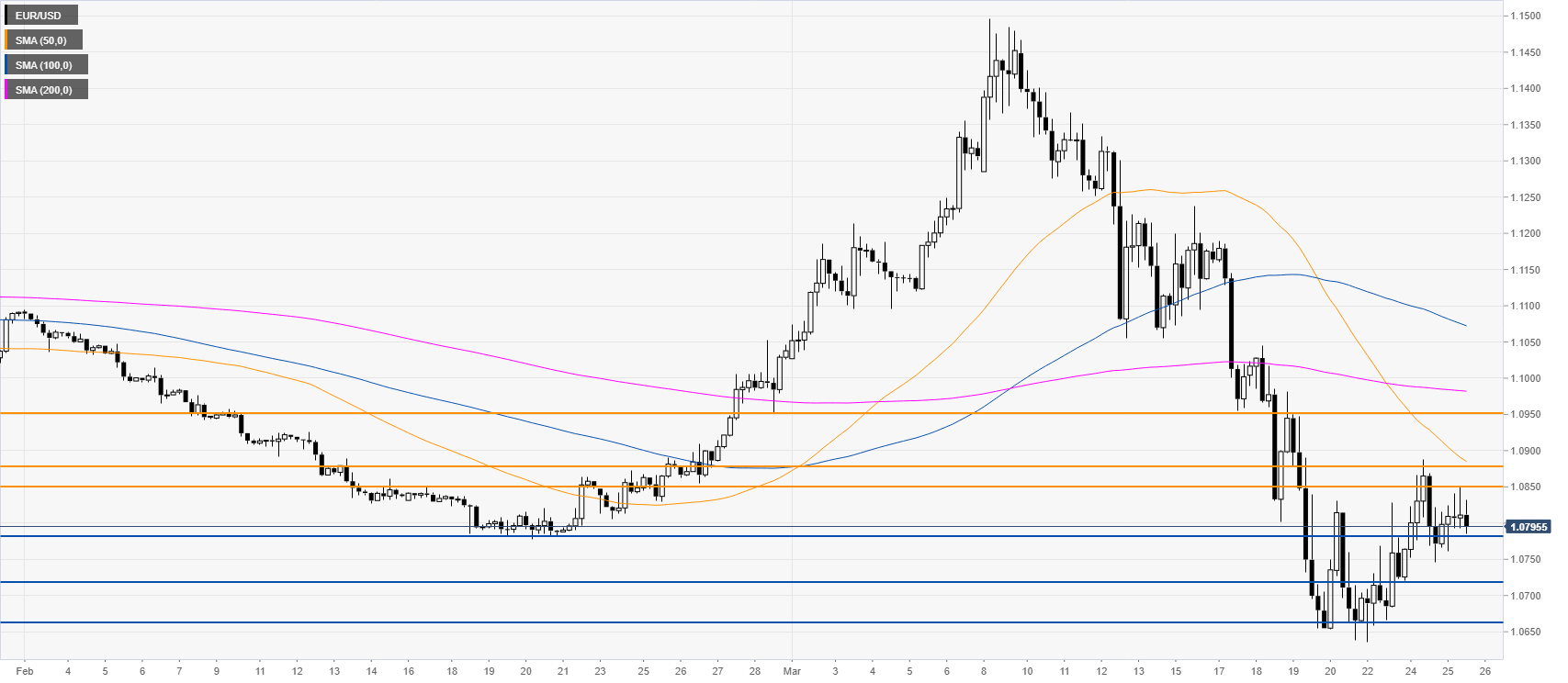

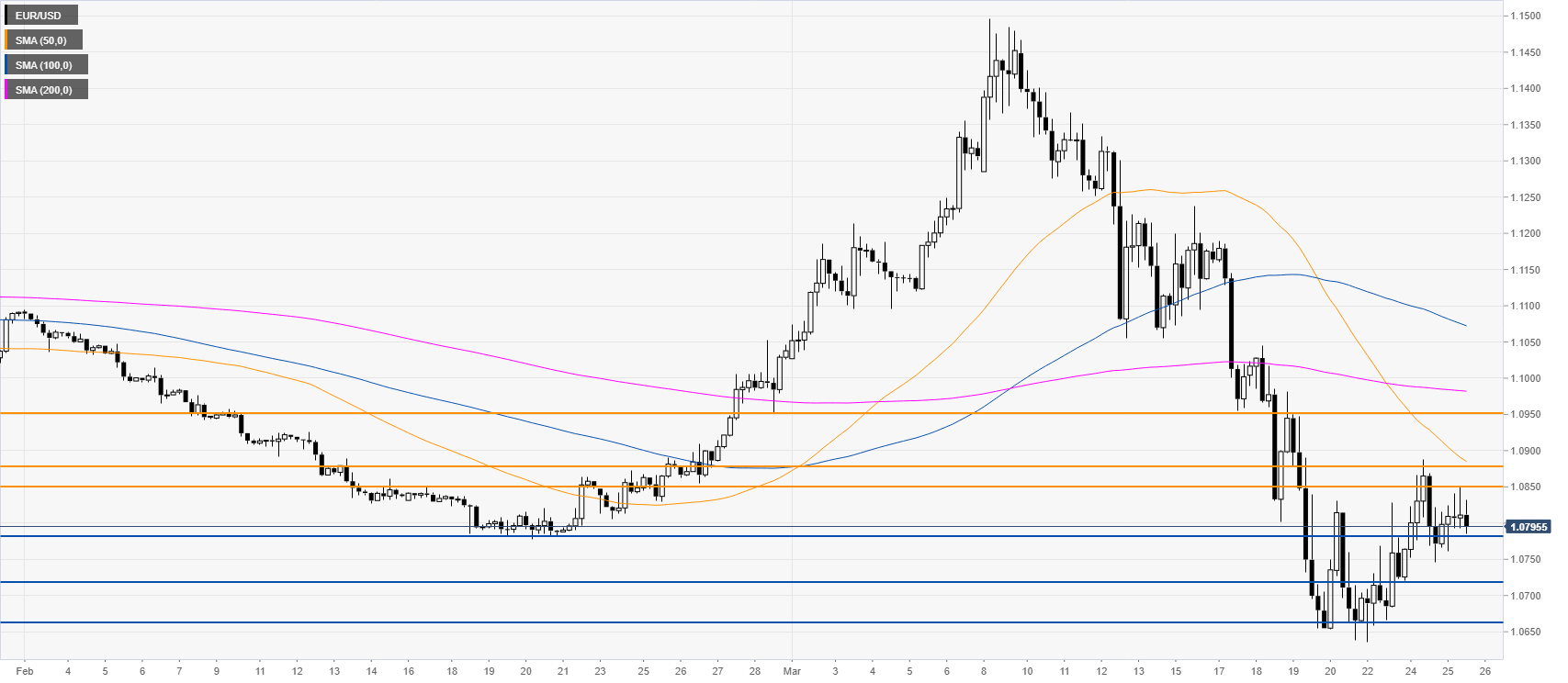

EUR/USD four-hour chart

EUR/USD continues to consolidate losses off monthly lows while trading below the main SMAs. As a matter of fact, the 50 SMA crossed below the 200 SMA which suggests more down. The correction is stabilizing near the 1.0800 figure as the range is nearing. The underlying tone remains bearish and sellers would be looking for an acceleration below the 1.0780 support en route towards 1.0723 and 1.0665 levels on the way down. Strong resistance can be expected in the 1.0850/80 price zone and at the 1.0950 price level, according to the Technical Confluences Indicator.

Resistance: 1.0850, 1.0880, 1.0950

Support: 1.0780, 1.0723, 1.0665

Additional key levels