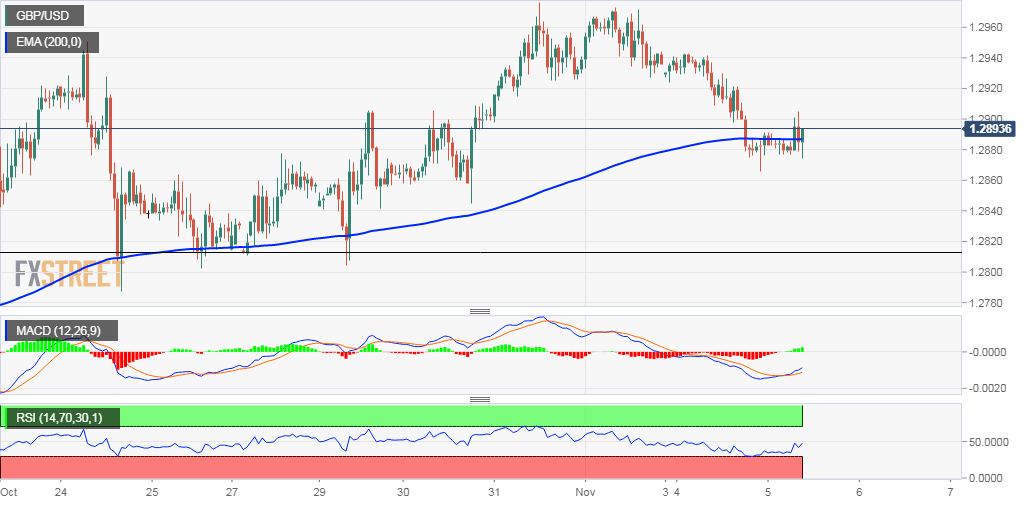

GBP/USD technical analysis: Pivots around 200-hour EMA, moves little post-UK PMI

- Bulls struggled to capitalize on the early uptick to levels just above 1.2900 handle.

- The downside remains cushioned following the release of upbeat UK services PMI.

The GBP/USD pair struggled to capitalize on its intraday uptick to levels just above the 1.2900 handle and refreshed session lows in the last hour.

Bulls showed some resilience at lower levels following the release of stronger UK services PMI for October, albeit lacked any strong conviction.

The pair has been pivoting around 200-hour SMA since the US session on Monday and thus, warrant some caution before placing any aggressive bets.

Meanwhile, technical indicators on hourly charts have just started gaining negative momentum and support prospects for further depreciating move.

However, oscillators on the daily chart maintained their bullish bias and seemed to largely offset the bearish outlook, rather attract some dip-buying interest.

The neutral set-up hasn’t been supportive of any firm direction, making it prudent to wait for a sustained move in either direction before placing fresh directional bets.

GBP/USD 1-hourly chart