Back

30 Oct 2019

EUR/USD technical analysis: Euro hovers near daily highs and 100-DMA ahead of Fed’s interest rate decision

- The Euro is trading at daily highs ahead of the Fed’s interest rate decision.

- The level to beat for buyers is the 1.1133 resistance in the near term.

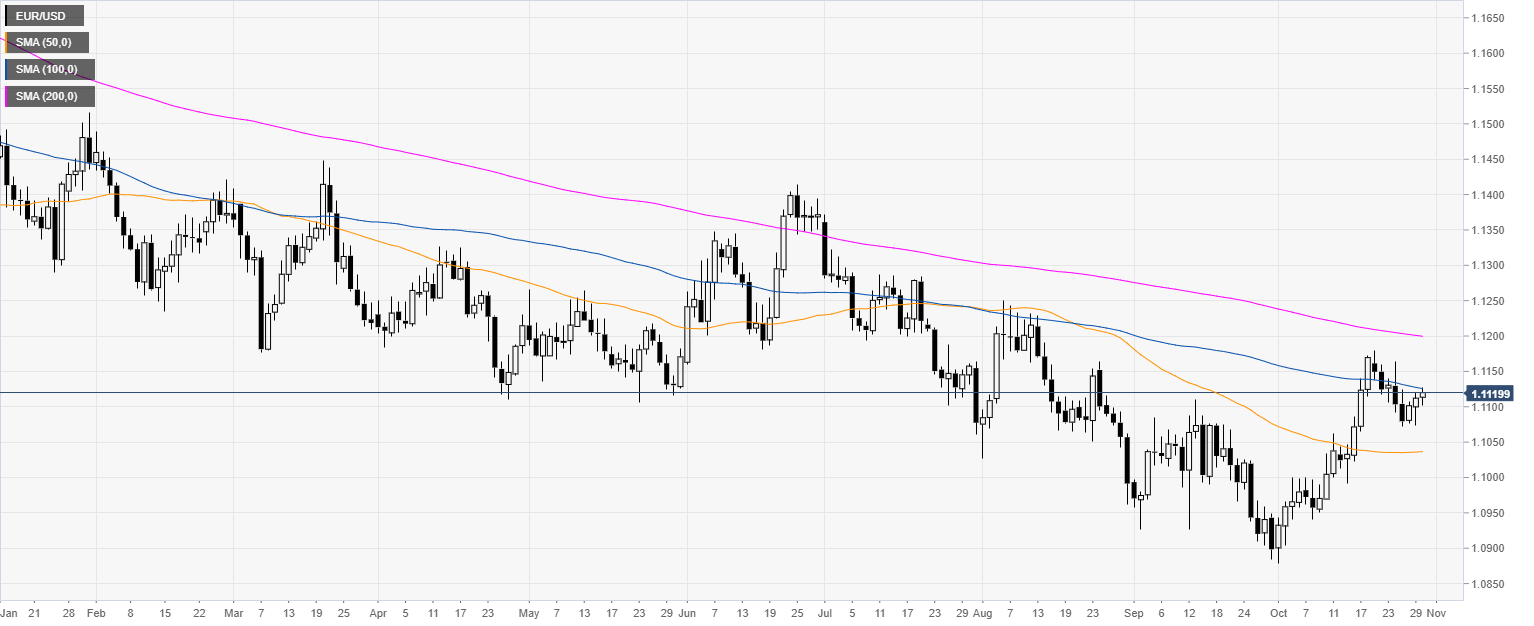

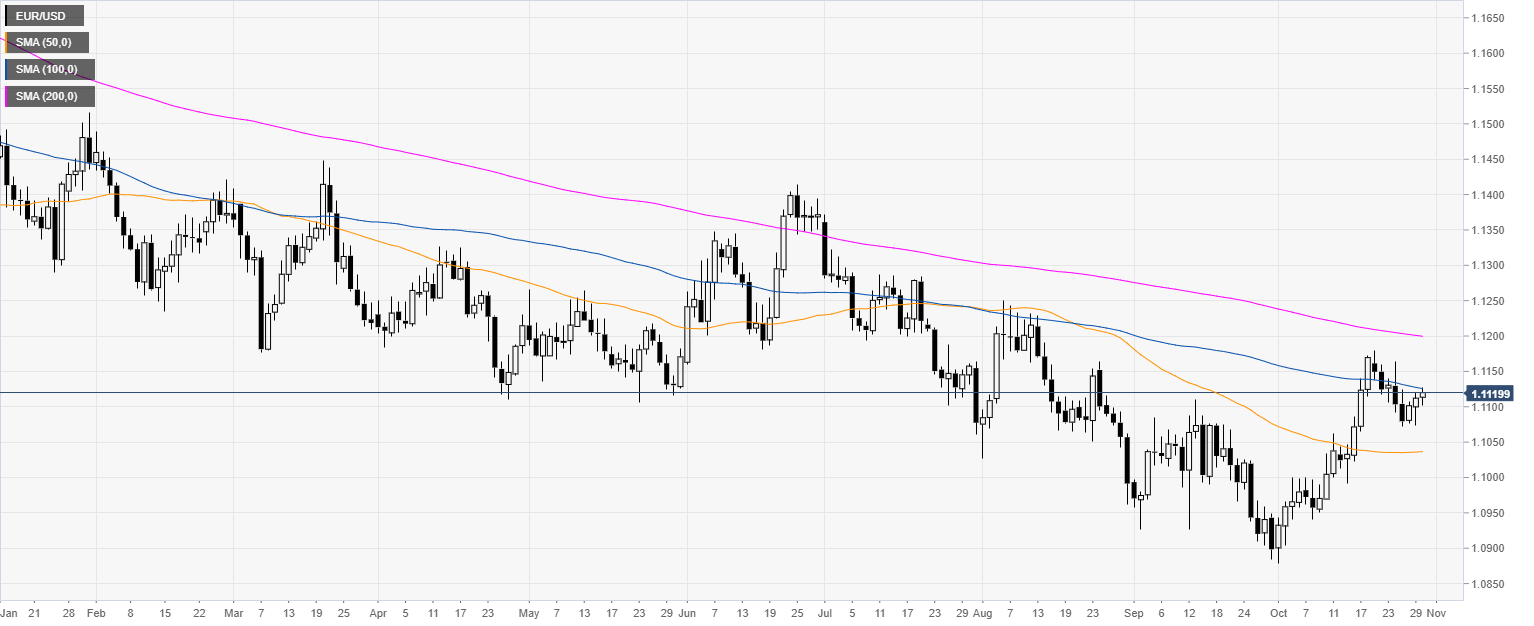

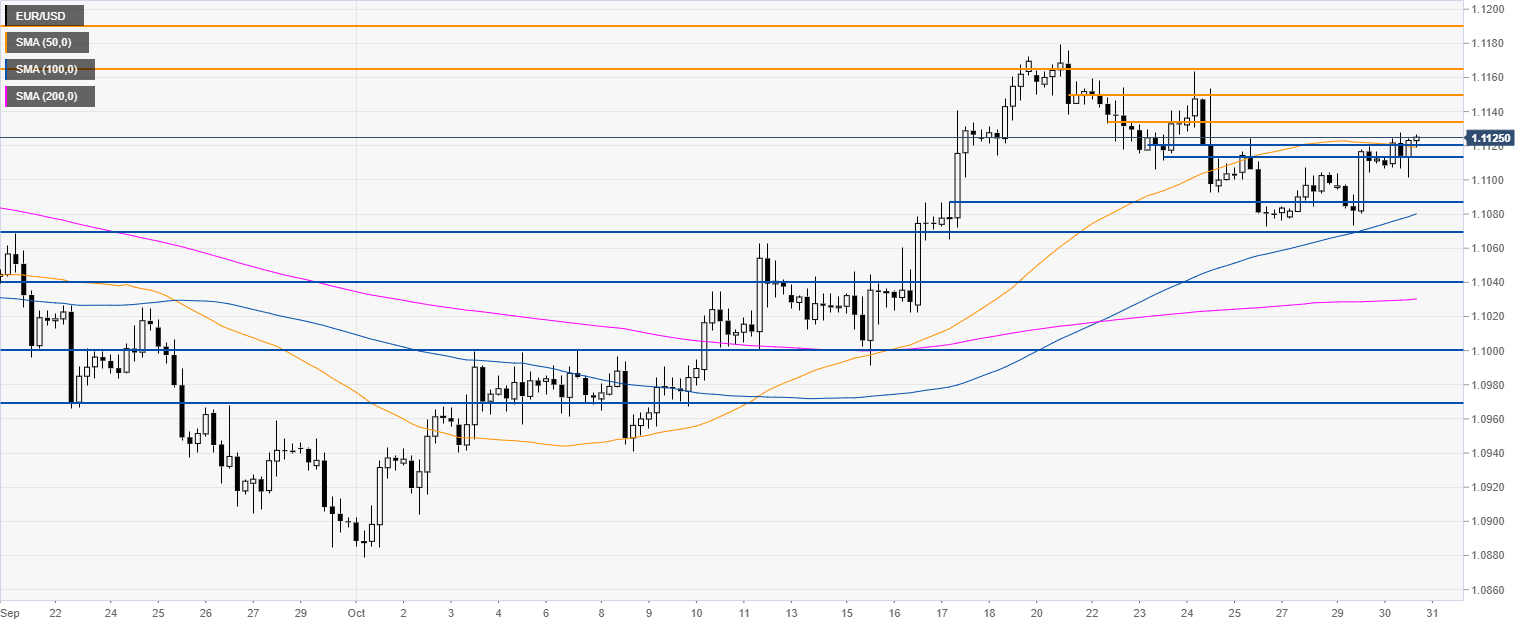

EUR/USD daily chart

On the daily chart, the Euro is trading in a bear trend below the 100 and 200-day simple moving averages (DMAs). Investors are likely waiting for the Fed Interest Rate Decision this Wednesday at 18:00 GMT.

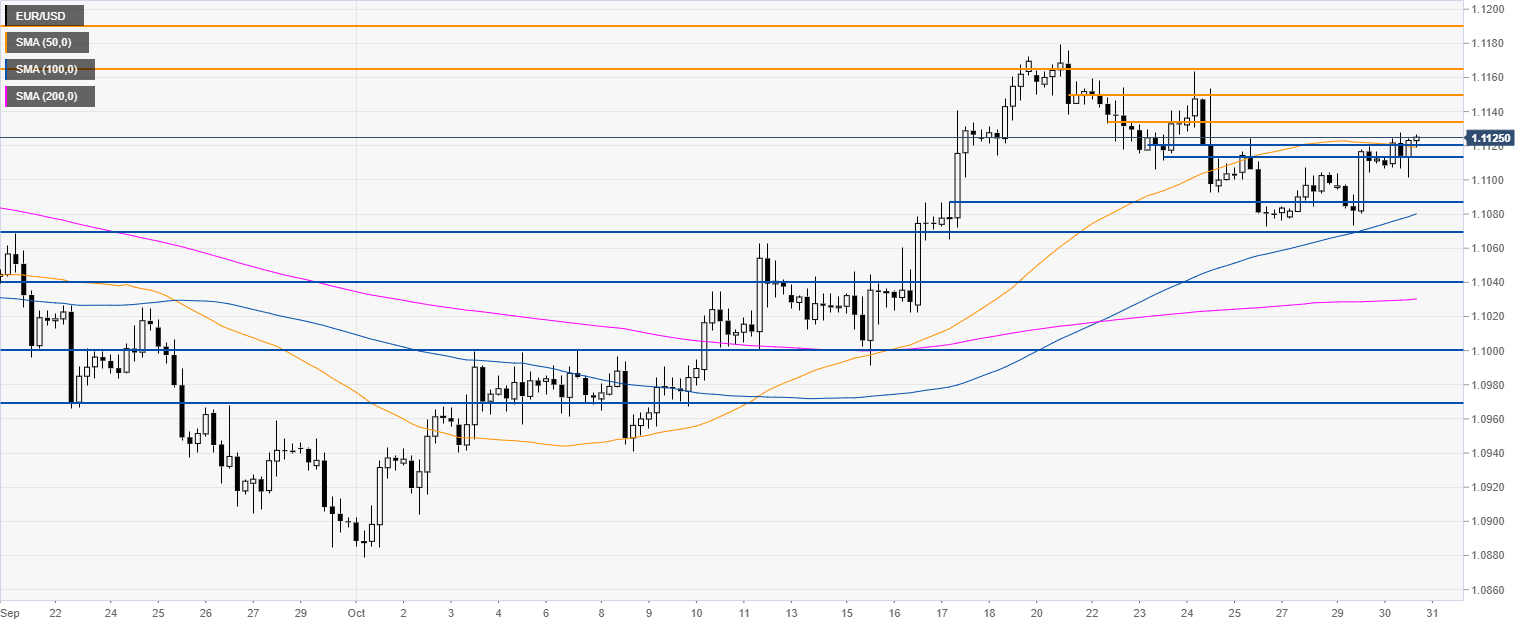

EUR/USD four-hour chart

The Fiber, on the four-hour chart, is trading above the 100 and 200 SMAs. The market is trading at daily highs above the 1.1113/20 support zone near the 50 SMA. The level to beat for bulls is the 1.1133 resistance. A break above it can lead the spot to 1.1150, 1.1165 and 1.1191, according to the Technical Confluences Indicator.

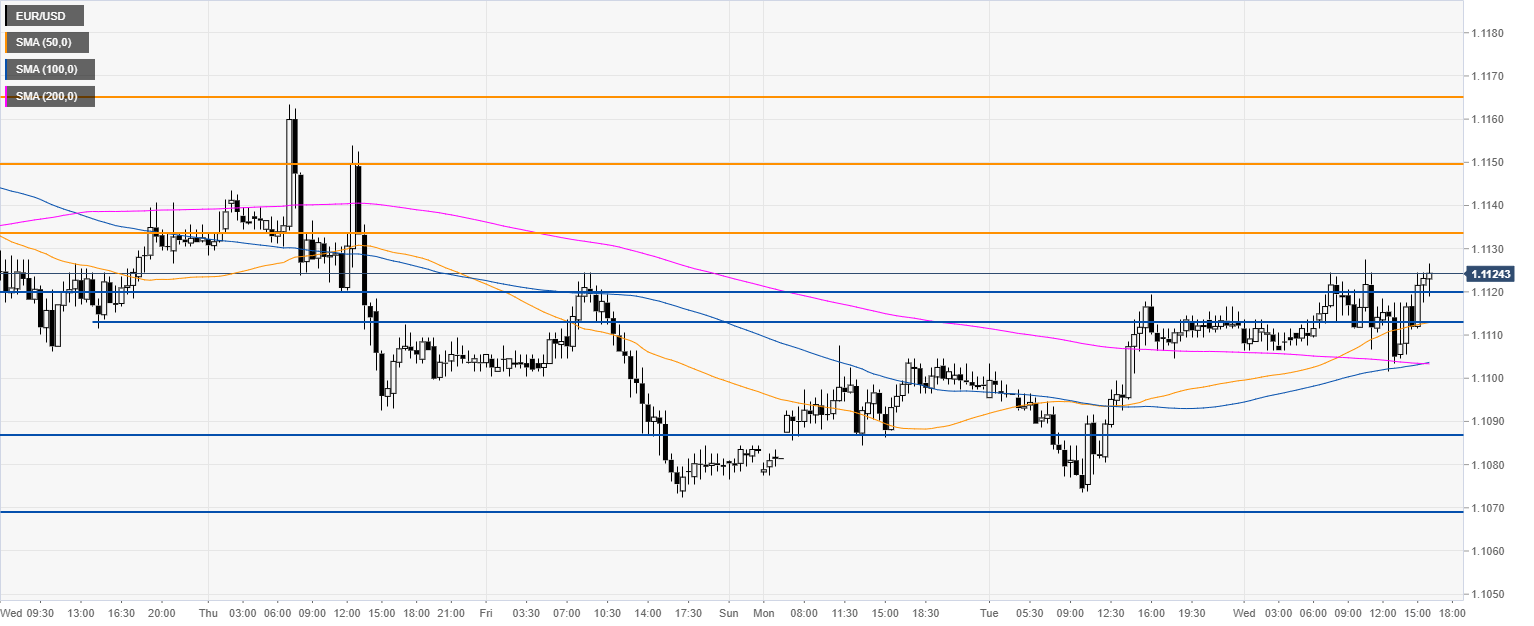

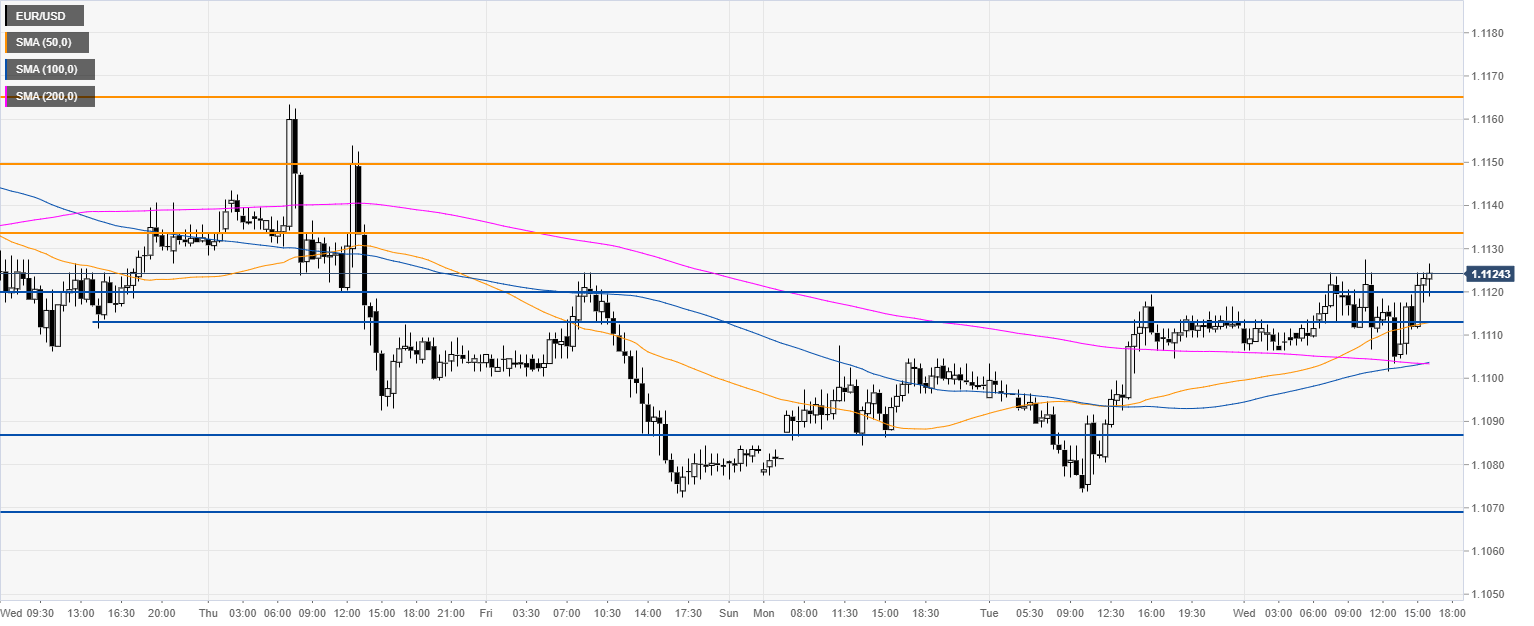

EUR/USD 30-minute chart

The EUR/USD is trading above its main SMAs on the 30-minute chart, suggesting a bullish bias in the near term. Support is seen at the 1.1113/20 zone, 1.1088, 1.1070 and 1.1040 price levels.

Additional key levels