Back

15 Oct 2019

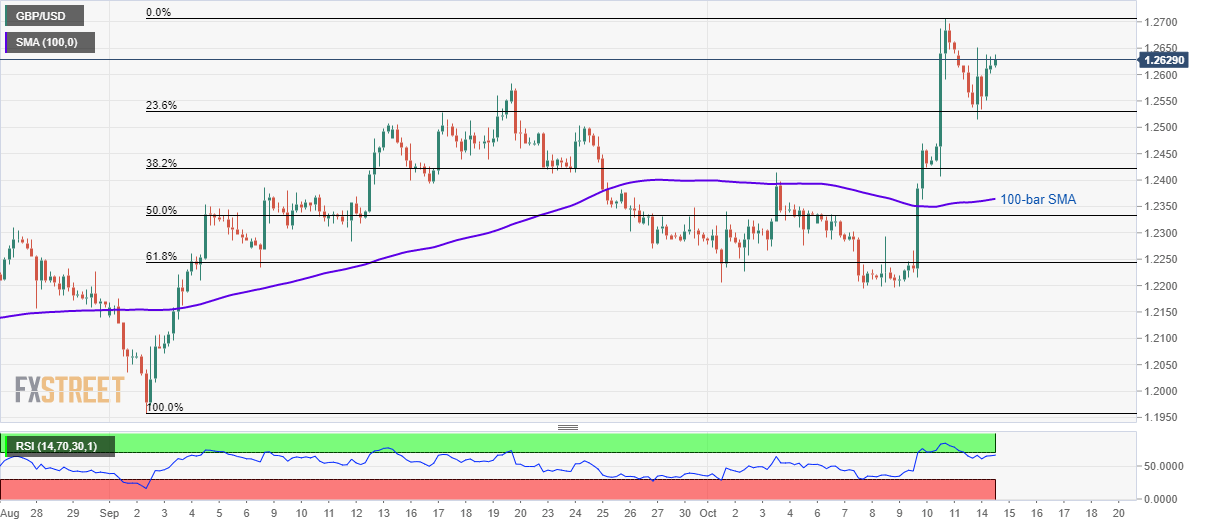

GBP/USD technical analysis: Overbought RSI favors another pullback

- GBP/USD bounces off 23.6% Fibonacci retracement, aims for monthly high.

- Overbought RSI conditions can recall 100-bar SMA on the chart.

The GBP/USD pair’s U-turn from 23.6% Fibonacci retracement flashes 1.2630 as a quote while heading into the London open on Tuesday.

The pair now aims for monthly tops nearing 1.2710 whereas June month high nearing 1.2785 and April lows close to 1.2920 will gain bulls’ attention afterward.

However, overbought conditions of 14-bar Relative Strength Index (RSI) seem to favor pair’s another pullback towards 23.6% Fibonacci retracement level of 1.2530 prior to highlighting 38.2% Fibonacci retracement figure of 1.2420 for bears.

During the pair’s extended downpour below 1.2420, 100-bar Simple Moving Average (SMA) at 1.2365 and 61.8% Fibonacci retracement level of 1.2245 seem the key to watch.

GBP/USD 4-hour chart

Trend: pullback expected