When are the UK CPIs and how could they affect GBP/USD?

The UK February CPIs Overview

The cost of living in the UK as represented by the consumer price index (CPI) is due later on Wednesday at 0930 GMT.

The headline CPI inflation is expected to arrive at 0.5% inter-month in February while the annualized figure is seen steadying at 1.8%. The core inflation rate that excludes volatile food and energy items is likely to remain unchanged at 1.9% last month.

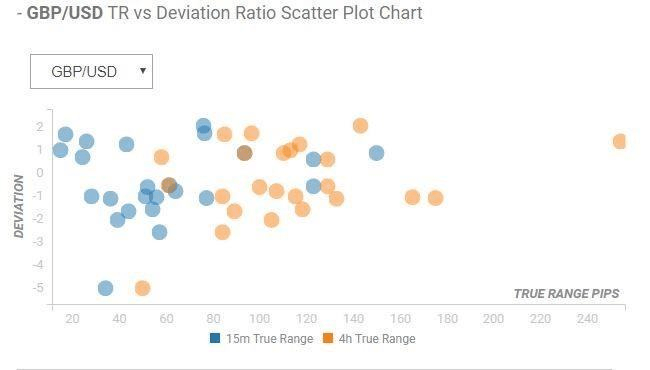

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 15 and 80 pips in deviations up to 2 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 120 pips.

How could it affect GBP/USD?

On a positive surprise, the GBP bulls will be rescued that could help the rates to regain the 1.3250 barrier, above which the next upside targets lie at 1.3269/74 (5-DMA, daily pivot) and 1.3300 (round figure).

If the readings disappoint, the GBP/USD pair could extend the latest leg lower to test the 1.32 handle, below which floors open up for a test of 1.3183 (Mar 18 low) and 1.3150 (psychological levels).

However, the reaction to the data may be short-lived, as the main focus now remains the UK PM Theresa May’s letter to the European Council President Tusk seeking a Brexit extension.

Key Notes

GBP/USD Forecast: Traders seemed clueless amid the recent Brexit chaos, UK CPI/FOMC eyed for some impetus

GBP futures: further rangebound likely

UK inflation preview: Why GBP/USD risks are skewed to the upside

About the UK CPI

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).