Back

15 Aug 2018

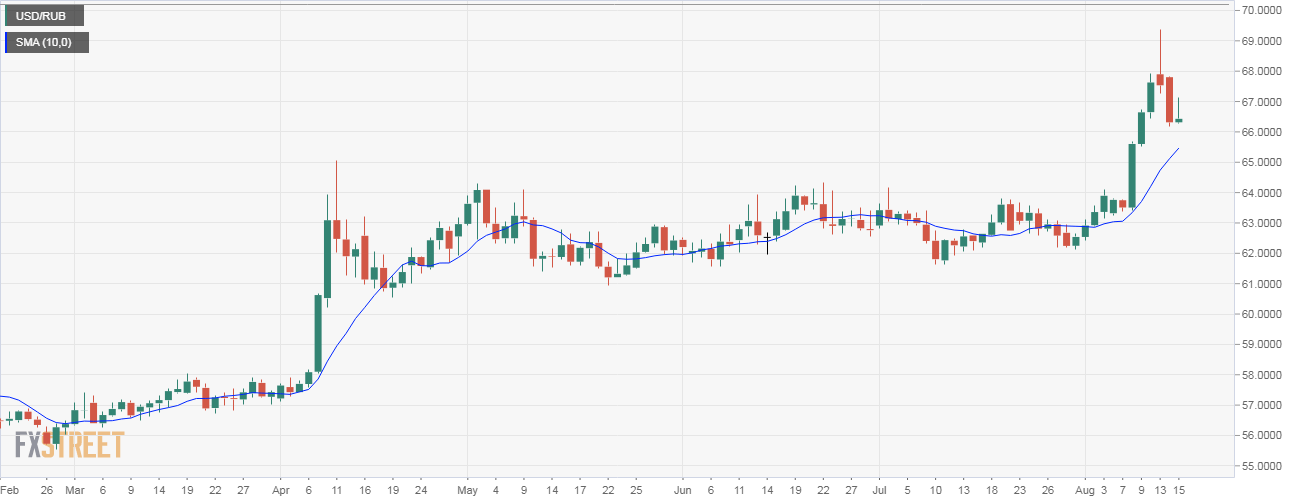

USD/RUB Technical Analysis: Short-term bearish reversal confirmed

- The USD/RUB pair created a large spinning top on Monday and posted a negative follow-through yesterday, confirming a short-term bullish-to-bearish trend change. As a result, the 10-day moving average (MA) support of 65.92 could be put to test.

- It appears the relief rally in Turkish lira is likely helping the Russian Rouble (RUB) score gains against the greenback.

- However, the downside in USD/RUB could be limited as the relief rally in the TRY could be short-lived, given the TRY put value is holding near record highs.

Daily chart

Spot Rate: 66.52

Daily High: 66.75

Daily Low: 66.52

Trend: Bearish

Resistance

R1: 67.26 (5-day moving average)

R2: 67.45 (200-hour moving average)

R3: 68.00 (psychological hurdle)

Support

S1: 65.92 (10-day moving average)

S2: 65.53 (previous day's low)

S3: 64.99 (Apr. 11 high)