GBP/JPY clocks 4.5-week high, what's next?

- Risk-on action in the equities is pushing Yen lower across the board.

- GBP/JPY hits 4.5-week high in Asia, nears 50-day moving average (MA) of 150.44.

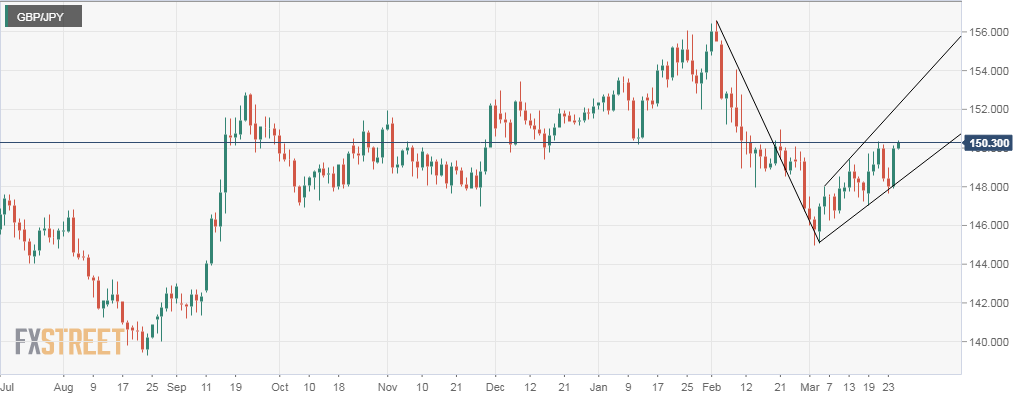

- The pair has created a bear flag-like pattern on the daily chart.

The sharp rise in the US stocks and the resulting weakness in the Japanese Yen pushed the GBP/JPY cross to 150.38 - its highest level since Feb. 21.

As of writing, the currency pair is trading at 150.25, having surged more than 200 pips yesterday. The risk assets found takers on Monday after Wall Street Journal reported the US and China are negotiating to avert a full-fledged trade war. The Dow Jones Industrial Average (DJIA) jumped 669 points, pushing the Yen and other anti-risk assets lower. Also, the risk-on seems to have hit the Asian shores. For instance, Shanghai Composite is flashing green; trading 1 percent higher on the day, as I write.

Further, the British Pound looks set to fly high against the American dollar, as indicated by the bullish technical setup. So, there is every reason to believe the GBP/JPY could cut through 50-day MA hurdle.

That said, the daily chart shows the cross has created an inverted bear flag-like pattern (bearish continuation pattern). A downside break would signal resumption of the sell-off from the Feb. 2 high of 156.61.

GBP/JPY Technical Levels

A clear break above 150.44 (50-day MA) could yield a test of supply around 150.00 (psychological hurdle) and 152.17 (61.8 percent Fibonacci retracement of Feb. 2 high - Mar. 2 low). On the downside, breach of support at 149.94 (session low) could yield a pullback to 149.31 (5-day MA) and 148.87 (10-day MA).

Daily chart