GBP/NZD big compression pattern ahead of New Zealand GDP

- UK expulses 23 Russian diplomats.

- NZ GDP expected to increase to 3.1%.

The GBP/NZD is currently trading at around 1.9055 virtually unchanged on Wednesday so far. Earlier, in relation to the murder of the ex-spy and his daughter in the UK, 23 Russian diplomats have been expulsed. While the GBP/USD has been affected negatively, the news had virtually no impact on the GBP/NZD which is still trading well within its range of 1.8940 and 1.9080.

With the US Session being macro news free, the market is taking clues from sentiment and possibly later from the New-Zealand GDP at 21.45 GMT, expected at 0.7% q/q and 3.1% y/y versus 2.7% in the previous reading.

Wednesday saw the UK spring statement on the budget, in which Hammond said that the UK's 2018 GDP growth forecast was revised up to 1.5% and making some upbeat comment on inflation saying that the Bank of England would likely reach its 2% target within a year. On the budget deficit, he said it would be £10b lower compared with 2010. The market was eager to buy the pound on the back of this positive outlook laid out by the finance minister.

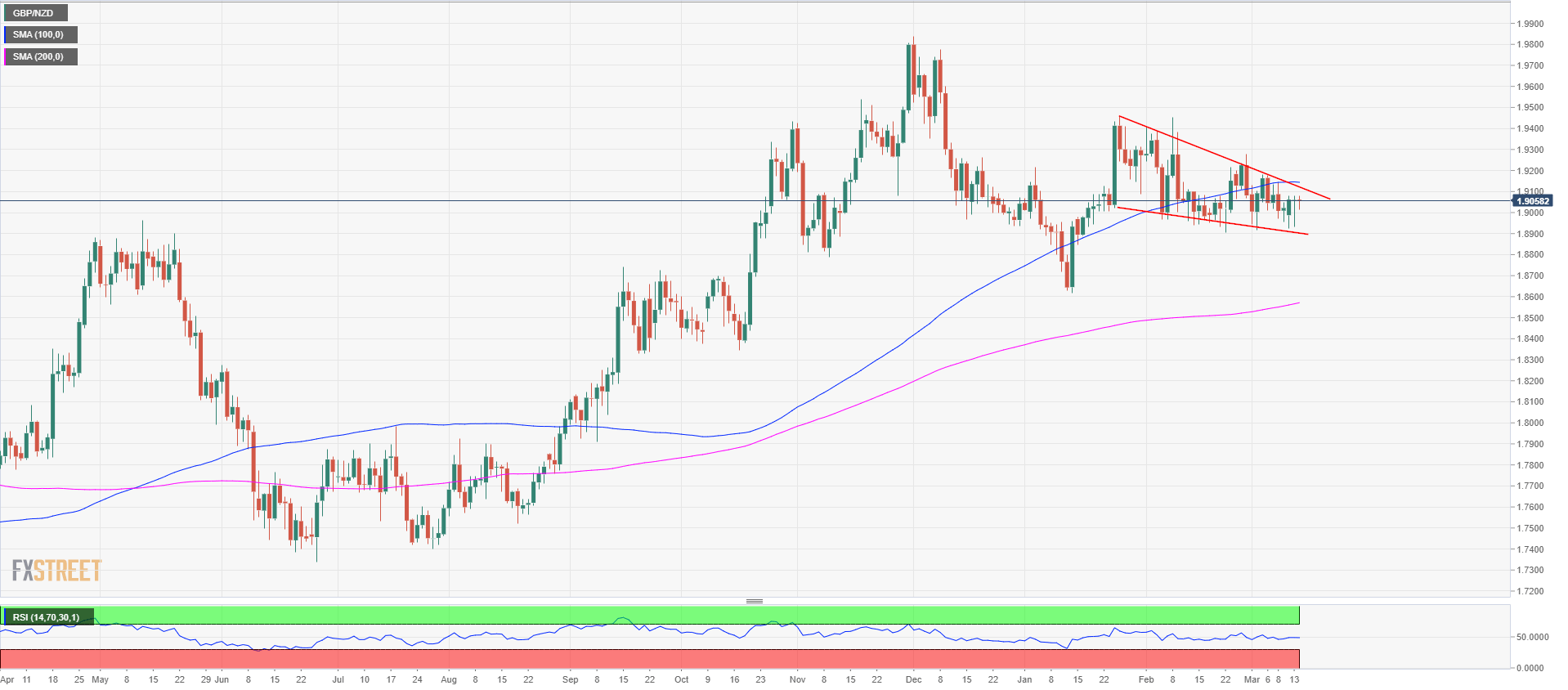

GBP/NZD daily chart

From a technical point of view, the GBP/NZD seems to be poised for a leg higher with a compression pattern which has been in the making since January 24 of this year. A clear breakout above the descending trendline (red) would likely lead to higher prices with 1.9400 being the first scaling point (highest point of the pattern), followed by 1.9800 cyclical high. On the flip side, if the pattern fails, support is seen at 1.8800 psychological figure and 1.8600 cyclical low.