WTI flirting with tops near $52.40, API on sight

- Oil bolstered by potential OPEC deal extension

- WTI trades in 4-week peaks

- Optimism intact on market rebalancing

Crude oil prices are prolonging the upbeat momentum during the first half of the week and are now helping the West Texas Intermediate to advance to multi-day tops in the $52.40 area per barrel.

WTI attention on API

Prices of the barrel of the American reference for the sweet light crude oil stay on the rise on Tuesday amidst increasing optimism over the likeliness of an extension of the current OPEC output cut deal beyond the March 2018 deadline.

In this regard, Saudi Energy Minister said earlier that ‘options remain open’, while he noted the oil cartel remains flexible. His comments added to Russian Oil Minister, who noted the compliance with the agreement remains strong.

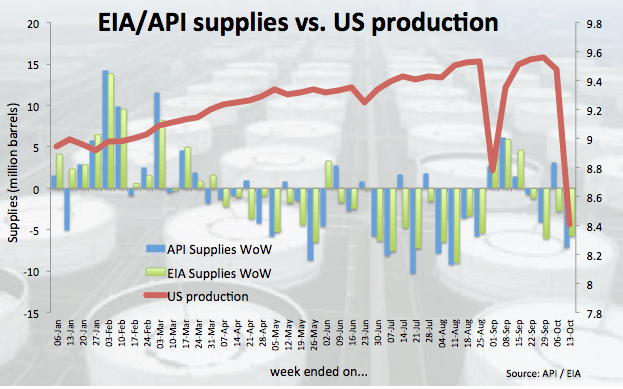

In addition, the recent US oil rig count released by driller Baker Hughes (Friday) dropped for the third consecutive week amidst lower US oil production, all bossting the sentiment around oil.

Ahead in the session, the API will publish its weekly report on US crude oil supplies ahead of tomorrow’s official report by the DoE.

WTI significant levels

At the moment the barrel of WTI is up 0.71% at $52.27 and a break above $52.37 (high Oct.24) would open the door to $52.86 (high Sep.28) and finally $53.76 (high Apr.12). On the flip side, the immediate support lines up at $51.61 (10-day sma) seconded by $50.70 (low Oct.20) and then $50.08 (38.2% Fibo of $45.58-$52.86).