Back

27 Jul 2023

Crude Oil Futures: A near term correction is not ruled out

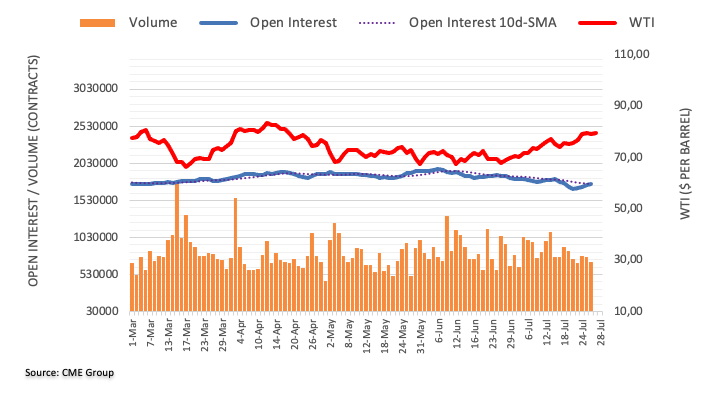

Considering advanced prints from CME Group for crude oil futures markets, open interest extended the uptrend for yet another session on Wednesday, now by nearly 3K contracts. Volume, instead, retreated for the second session in a row, this time by around 70.6K contracts.

WTI remains capped by $80.00 so far

Prices of WTI reversed four sessions of gains on Wednesday. The daily decline came on the back of increasing open interest and a strong drop in volume and points to a potential consolidation around current levels. In the meantime, the immediate target remains at the key $80.00 mark per barrel for the time being.