Back

16 Jun 2023

USD/CAD Price Analysis: Bulls make a move within bearish territory

- USD/CAD bulls could be starting to make a move.

- USD/CAD bears eye a downside extension while frontside of the trendline resistance.

The Canadian Dollar strengthened to a nine-month high vs. the Greenback on Thursday and into an area of temporary support as the following technical analysis will illustrate. The rally in the CAD has stemmed from firmer oil prices, recent strength in Canadian data and central bank divergence themes. However, a meanwhile correction is feasible at this juncture when inspecting the daily chart as follows:

USD/CAD daily charts

The market has dropped into prior lows and bears are working their way into stop territories.

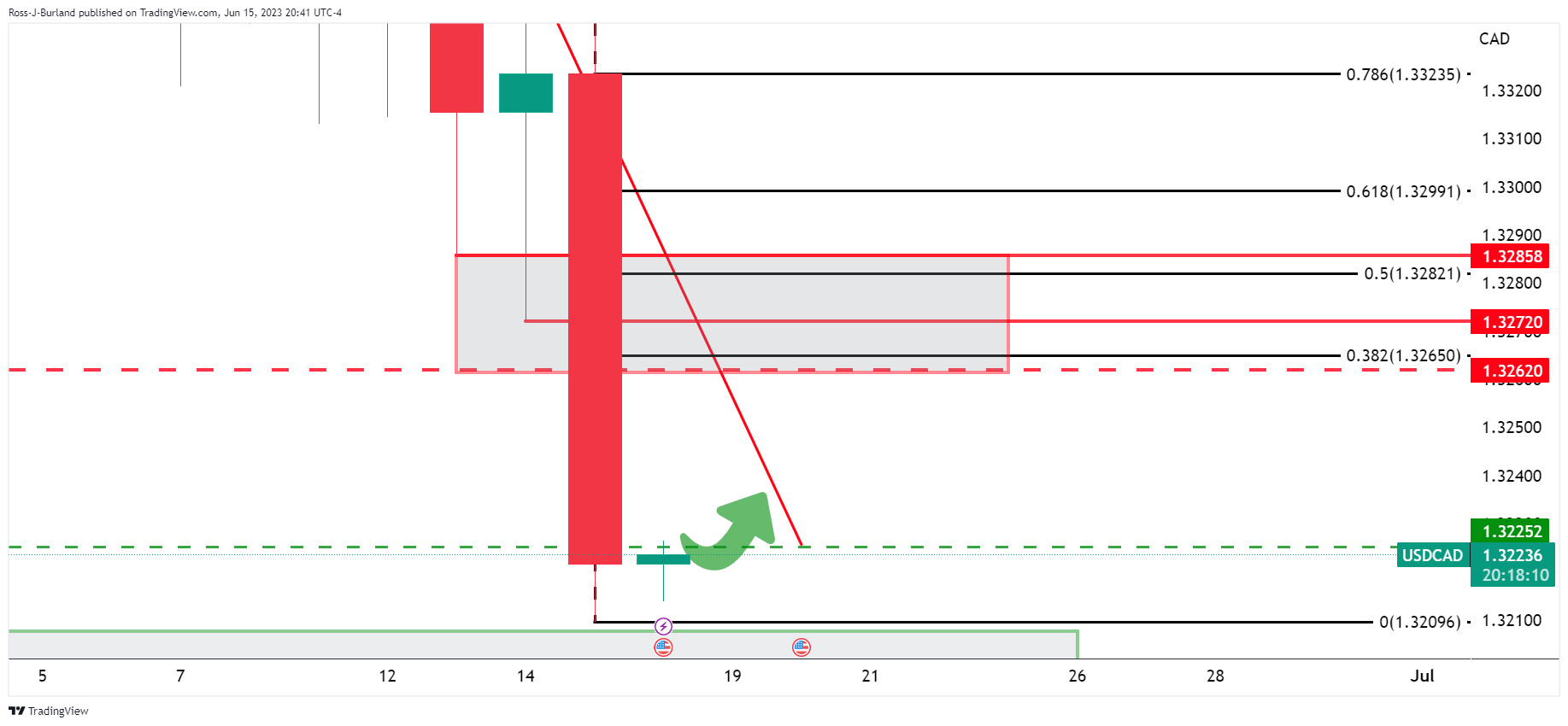

Meanwhile, a temporary correction could be underway at this point with a focusing the trendline resistance:

USD/CAD H1 chart

The hourly charts show signs of deceleration and prospects of bullish structure building.