How to spend smarter: 8 working hacks

Track your spending with Telegram bots

Сut useless expenses within 15 minutes

Find the best investment plan for you

Avoid impulse purchases with Shortcuts

Don't fall for marketing tricks

You are here, and it means you are interested in trading. Even as a novice, you understand trading is about strategies, monitoring trends, and discipline. Interestingly, many find Forex markets easy enough to learn, but mastering everyday spending feels like cracking a black box. However, money management requires the same discipline, trend spotting, and optimising finances accordingly. This guide compiled the best tips for managing your bank accounts and cash flow. As a result, you will always have enough to meet your basic needs and save some extra to fund your trades and cover your unexpected expenses or simple joys.

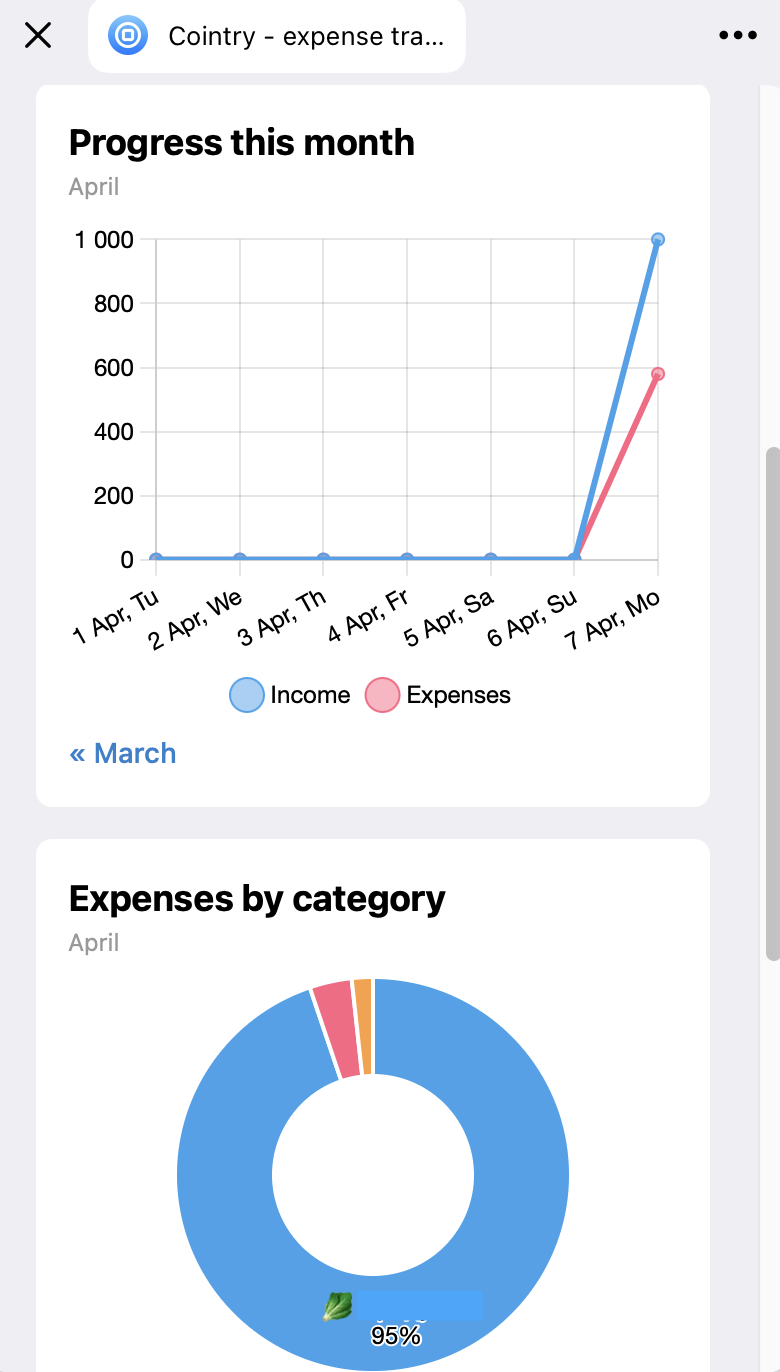

There are plenty of tips on how to spend money wisely. Most of them look totally non-sweat, and you've most likely heard them all: track your expenses, plan your budget, and don't make impulse purchases. But how many of you easily follow them when it comes to action? We decided to go beyond generic advice and give you a list of precise practices to apply. The very usual advice is to track your spending, check its patterns, and cut your expenses from the most money-consuming categories. However, it usually works like this: you decide to begin spending money wisely from Monday on, and start tracking your expenses with something like Wallet or Money Lover. In three days, a week at most, you get tired and drop it off. Things can be much easier, though. Once we have AI, we can perform the same actions in our familiar messengers without focusing too much on it. One example is Telegram bots, such as Cointry. Here is what you do with it: Send the bot simple messages with your expenses in the format: [how much] [what], for example, 10—coffee. Later, you can track your statistics with a simple bot command /stats and clearly see where you can cut your expenses.How to spend smarter: 8 working hacks

Track your spending with Telegram bots

Сut useless expenses within 15 minutes

Here, you need about 15 minutes of your time and particular actions. Here is a step-by-step instruction:

- Check all your subscriptions to digital services and cancel any subscriptions to apps you haven't used for at least a month.

- Go through your food and shopping apps. Leave only one app from every category; if you don't find meals or clothes in these apps, that's the point: you won't purchase them this time.

- Look at your Internet/phone or other essential subscriptions. Check if you can switch to annual plans, which can save up to 20% on your yearly expenses.

Give your money a purpose

When you have a lump sum, blowing it on the best sales and quick dopamine pleasures like food delivery is tempting. This doesn't sound like spending money wisely. Here is what's recommended to do instead:

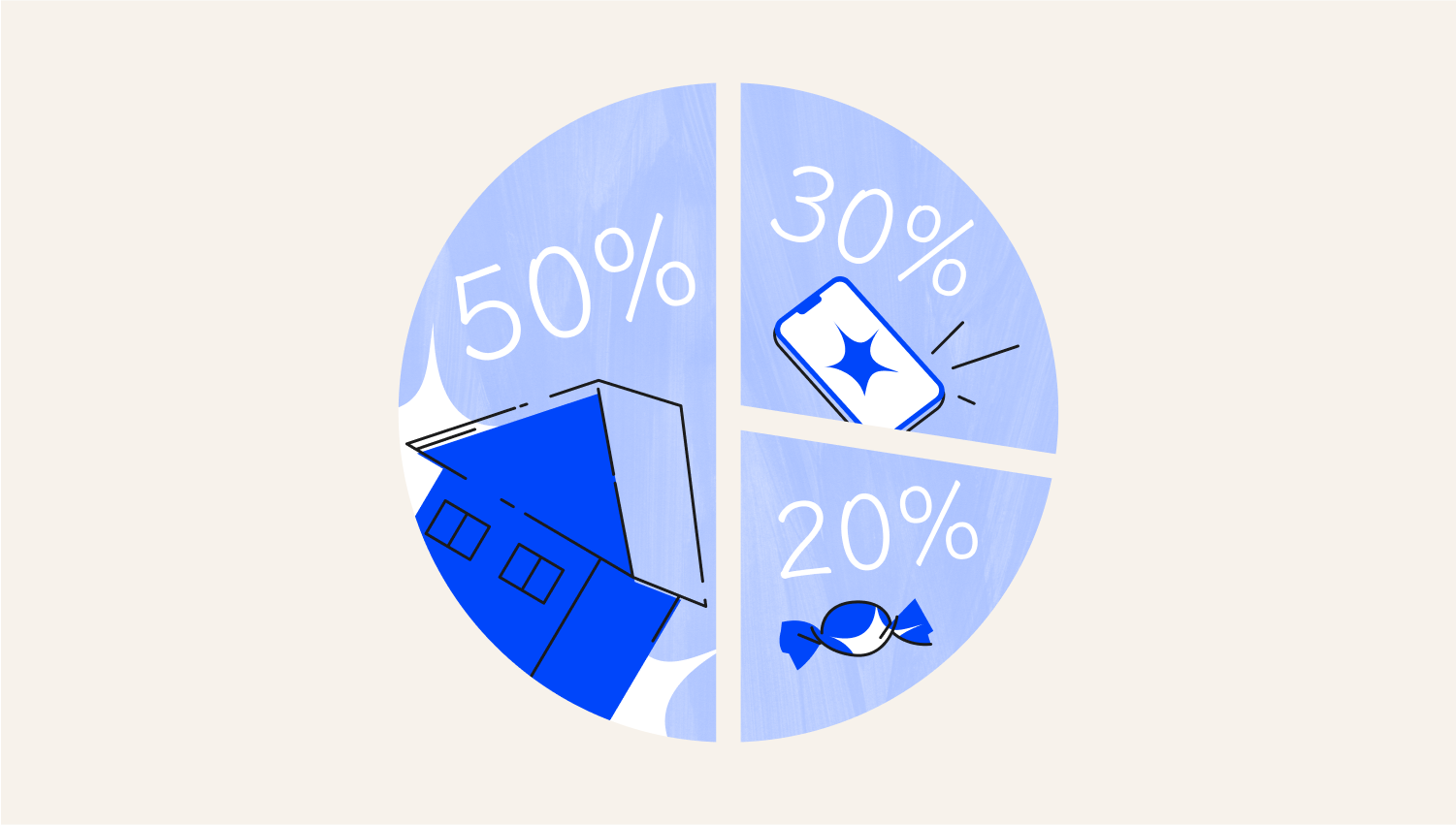

Spread your funds in the following proportion:

- 50%—for basic needs (house rent, food, utility bills, transportation, phone bill);

- 30%—for goals (vacation, new tech, emergency funds);

- 20%—for guilt-free spending (to avoid burnout splurges).

Tip for traders: If you want to trade with a broker, allocate a maximum of 10%–20% from your Goals budget piece.

Find the best investment plan for you

Money should work for you—that's something you've definitely heard. How to spend money wisely on an investment? Here is a very straightforward scheme for this:

For beginners:

- Buy S&P 500 (VOO, SPY) or MSCI World (URTH).

- Set up auto-invest $50–100/month (DCA strategy).

- Gold: 5–10% of the portfolio in Gold ETFs (GLD) or digital gold.

For moderate risk-takers:

- Buy shares of stable companies (Coca-Cola, Procter & Gamble).

- Reinvest dividends automatically (DRIP).

- Invest in BTC + ETH max 5–10% of portfolio.

For pros:

- Buy growth stocks: tech (Apple, Nvidia), AI, EVs.

- Apply to P2P lending/crowdfunding (like Mintos, Fundrise).

- Start angel investing (if you have $10k + spare).

Note: Don't put all your money in a single stock or crypto—diversify your portfolio. And never follow 'hot tips' from Reddit or other forums.

Create a budget

To create a budget, follow these steps:

- Assess your income. Calculate your total monthly income, including salaries, bonuses, and any other sources of revenue.

- Track your expenses. Identify all your monthly expenses, such as rent, utilities, groceries, transportation, and discretionary spending. Categorise them into fixed and variable costs.

- Set financial goals. Define short-term and long-term purposes, such as saving for a vacation, paying off debt, or building an emergency fund.

- Allocate funds. Use the 50/30/20 rule we’ve described above.

- Track and adjust your budget. Monitor your spending regularly using apps or spreadsheets. Correct your budget if needed to stay on track with your goals.

- Automate savings. Set up automatic transfers to savings accounts or investment plans to ensure consistent contributions.

- Review the budget monthly. Reevaluate your plan each month to account for changes in income or expenses.

Avoid impulse purchases with Shortcuts

First, we'll calm you down—you are not alone! According to Statista, consumers in the United States spend $150 on impulse purchases monthly. So it's kind of normal, but it can still result in at least some spending guilt.

The problem is universal, and simply banning yourself from buying the next 'must-have' gadget doesn't work. Many experts suggest asking yourself, 'Do I really need this?', but the answer is usually 'Yes', right? However, you can make your phone do this for you, and this will act as an external judging voice, one that's far harder to ignore.

You can easily do this with the help of your smartphone shortcuts:

| For iOS users | For Android users |

| Open Shortcuts app → Go to Automation tab | Install MacroDroid |

| Tap + → Create Personal Automation | Create a macro: Trigger: App Launched → Select payment apps |

| Select App → Choose your banking/payment apps (e.g., PayPal, Revolut) | Action: Pop-up Alert → Custom text: 'Wait. Is this a NEED or a WANT?' |

| Add action 'Show Notification' → Type: 'Are you SURE you need this?' | Bonus: add vibration to interrupt impulse spending |

Don't fall for marketing tricks

Most marketing tricks are based on pains, triggers, and fears. One of them is FOMO—fear of missing out—when marketers create a sense of a huge opportunity a client is about to lose forever.

They usually exploit countdown timers, fake scarcity, fake discounts, or the crowd effect to trigger FOMO. Here are some effective ways to spend money wisely despite all the witty marketing tricks:

- Check the actual price. Use Google Lens to find a product by photo, or check the price history with a special app—for example, Keepa for Amazon.

- Put the item in a cart. Even if they claim it was the last size or the last-minute 70% discount, the product will most likely stay on your card at the same price. A couple of such reality checks will train you not to become triggered by FOMO practices.

- Use shopping sites from the Incognito browser mode. Sites personalise prices based on your browsing history. Incognito resets this, showing you the real, often lower price and product popularity level.

Wait for sales and discounts

Why purchase at full price when there are real discounts around? There are apps where you can track price history, like Keepa or CamelCamelCamel for Amazon.

Besides, keep in mind the top dates for the best deals: Black Friday, January (post-holiday), national holidays, and end-of-season sales.

Final thoughts